Opening Price, Initial Buy & Reserve Ratio**

The Opening Price is the desired price that is set for the TEC token when it becomes available for exchange through the Augmented Bonding Curve Before the Initial Buy.

The Initial Buy is the first buy of TEC tokens that happens at launch to mint tokens for the Commons collective Governance. It will take place at the Opening price, but as the buy is expected to be large (~250k wxDai) there will be slippage and it will greatly change the Price that TEC will list at for launch.

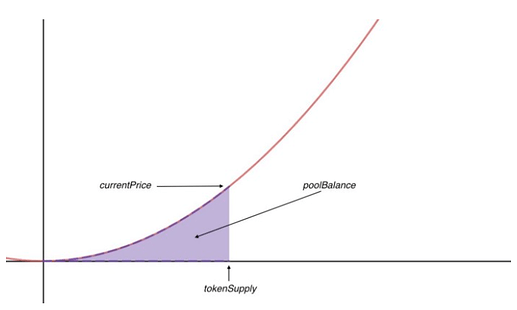

The Reserve Ratio is a ratio between the market cap of the TEC token (token supply x unit price) and the value of the Reserve balance (wxDai) that will be fixed for the life of the Augmented Bonding Curve…

Implications & Parameter Options

You will have the option to set the Opening Price to any ($) amount that you would like, 1 wxDai = 1 US dollar. This choice, in pairing with the Commons Tribute establishes the Reserve Ratio which sets the relative price sensitivity for the TEC token.

![]()

The opening price you set will dictate the Reserve Ratio. The total supply of TEC tokens minted will be dependent on how much wxDai is received by the HatchDAO during the Hatch Period. The minting rate is set at 1:1 (wxDai : TEC), so if we reach our minimum target goal (800,000 wxDai) we will have a total supply of 800,000 TEC Tokens.

The total value locked up in the Reserve Pool is dependent on both the amount of wxDai raised, and the Commons Tribute (%) parameter that you established earlier. In order to make this easier to understand, lets look at an example with our minimum target goal:

Total amount Raised: 800,000 wxDai

Total TEC minted = 800,000

Commons Tribute (%) = 20%

Common Pool = 160,000 wxDai

Reserve Pool = 640,000 wxDai

In this scenario, we set our Commons Tribute (%) parameter to 20, which allocated 20% of the total funds raised to the Common Pool (a total of 160,000 wxDai), and the remaining 80% to the Reserve Pool (a total value of 640,000 wxDai).

If we take our equation, RR = Reserve Pool / (Total Supply of TEC * OPENING PRICE), we end up with our RR = 640,000 wxDai / (800,000 * OPENING PRICE). If we want our Reserve Ratio to be locked at 1, the opening price would have to be $0.80. It is important to understand that this ratio will be locked throughout the lifetime of the Bonding Curve.

Since the Reserve Ratio is fixed, the purchase and sell of TEC tokens within the ABC will change the total supply of tokens as well as the price of each token with respect to the reserve balance and will be recalculated to maintain the configured reserve ratio between them.

Understanding that setting the Opening Price parameter locks in our Reserve Ratio is incredibly important, but what does it mean? Well, it has a lot to do with price sensitivity (the magnitude of volatility a single buy or sell from the curve has on the TEC price). A higher reserve ratio between the Reserve Pool balance and the TEC token will result in a lower price sensitivity, meaning that each buy and sell will have a less than proportionate effect on the TEC price movement. Conversely, a lower ratio between the Reserve Pool balance and the TEC token will result in higher price sensitivity, meaning that each buy and sell will have a more than proportional effect on the TEC price movement.

Other implications to consider are the spectators, buyers, and the general public who are interested in participating within the TEC economy. For most of us, we are receiving TEC tokens in the low 1 wxDai range, so setting an opening price at $21.00 will probably force people to hesitate with their decision to buy into our economy, hoping to buy in at a lower price, even if we establish a substantial vesting period through our Token Freeze and Token Thaw parameters. If we set the price too low, we take a risk of not generating enough funds to fully support the TEC economy during the early days.

The ABC is a very complex mechanism, and each decision has implications for so many others, so it is extremely important to evaluate this parameter with care.

Related Parameters to consider when defining the Opening Price parameter:

Token Freeze

Token Thaw

Commons Tribute

Suggested Range

$0.60 - 6

Note this post was heavily edited to update the post to the evolving state of deployment