The Bolshevik’s Gambit fork with Revolutionary Opening Price and Iron Curtain Conviction Voting - Issue 109

What is the overall Commons Configuration strategy?

We are charting out into new territories of ideology, coalescing into forms of governance and economics. We have rallied a strong community around our cause with our Trusted Seed. We should be confident in our cultural build to guide us to where we need to go without imposing technical red tape on our primary revolutionaries.

We have to recognize that the TEC at launch will not be same force as it will be in 6 months. We can expect to expand and mature with time and our post-launch settings will adjust to reflect our evolution. I have outlined envisioned changes in this proposal.

A low opening price reduces the sell pressure once we go post token freeze, likely adhering hatcher’s to our mission rather than salivating like wild beasts over the token price. However newcomers will want to take part and the buy pressure with such a low opening price will be considerable. with an ample entry tribute we can hope to secure a further amount of funding, while slightly dissuading sells with a slightly higher exit tribute.

The relationship between our reserve balance and reserve ratio will provide us with an interesting price volatility in the beginning. This is due to having such a low reserve balance, but becomes more stable as it increases because of a solid reserve ratio of ~20%. Volatility is a feature of most revolutions - we have solid foundations however and things will stabilize with time. We capture DAO funds from this volatility and use it to fund our Common’s objectives.

Tao Voting allows us to react to any discrepancies between delegates voting and the will of the community, giving ample time to react in case of contention or incongruence between the two parties. In an uncontested vote we can hope to complete a Tao Vote in one week.

In this fourth edition we combine some insights I gleaned into the heart of conviction voting while designing the conviction voting settings for Giveth with Griff and Lauren. Welcome the Iron Curtain because it will protect us from outside forces draining our common resources!

FORK THIS PROPOSAL (link)

Summary

Module 1: Token Freeze & Token Thaw

| Parameter | Value |

|---|---|

| Token Freeze | 12 Weeks |

| Token Thaw | 52 Weeks |

| Opening Price | 1 wxDAI |

Module 2: Augmented Bonding Curve

| Parameter | Value |

|---|---|

| Commons Tribute | 70.00% |

| Entry Tribute | 8.00% |

| Exit Tribute | 10.00% |

| *Reserve Ratio | 19.34% |

*This is an output. Learn more about the Reserve Ratio here.

Module 3: Tao Voting

| Parameter | Value |

|---|---|

| Support Required | 88% |

| Minimum Quorum | 8% |

| Vote Duration | 6 day(s) |

| Delegated Voting Period | 3 day(s) |

| Quiet Ending Period | 2 day(s) |

| Quiet Ending Extension | 3 day(s) |

| Execution Delay | 1 day(s) |

Module 4: Conviction Voting

| Parameter | Value |

|---|---|

| Conviction Growth | 7 day(s) |

| Minimum Conviction | 4.0% |

| Spending Limit | 18.0% |

Module 1: Token Freeze and Token Thaw

Strategy:

Revolutions happen quickly. We have supreme confidence in our plan to create an amazing Commons and generate value. 3 months Freeze is a reasonable amount of time in crypto to hold tokens. That being said, a year of Thaw means that TEC holder’s will be very unikely to sell their Tokens for a while since so little will be available. If they intend to sell they will wait and speculate a bit longer.

Taking this into consideration as well we have to “Trust” our trusted seed. These Hatchers are not likely to sell en masse anyway unless we really mess up.

| Parameter | Value |

|---|---|

| Token Freeze | 12 Weeks |

| Token Thaw | 52 Weeks |

| Opening Price | 1 wxDAI |

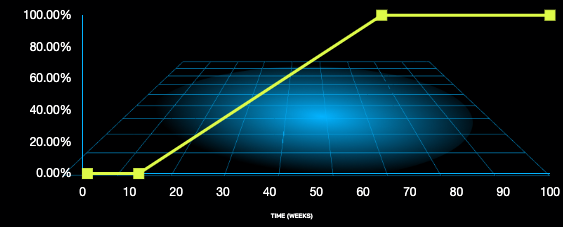

Hatcher’s TEC Release Schedule

This is the release schedule for TEC that was given to Hatchers. Their TEC will start out frozen and then slowly become liquid according to the graph above.

Token Release Timeline

| Duration | % of Tokens Released | Price Floor of Token |

|---|---|---|

| 3 months | 1.92% | 0.98 wxDAI |

| 6 months | 26.92% | 0.73 wxDAI |

| 9 months | 51.92% | 0.48 wxDAI |

| 1 year | 76.92% | 0.23 wxDAI |

| 1.5 years | 100.00% | 0.00 wxDAI |

| 2 years | 100.00% | 0.00 wxDAI |

| 3 years | 100.00% | 0.00 wxDAI |

| 4 years | 100.00% | 0.00 wxDAI |

| 5 years | 100.00% | 0.00 wxDAI |

Module 2: Augmented Bonding Curve (ABC)

Strategy:

We’re coming to realize we’ll need a good chunk of money to kick-start our vision and to adequately reward contributors and fund WGs and projects. This leaves us well over 800k to ignite the revolution.

A low opening price is fine because Hatcher’s are true believers in the cause, in the collective well being of the Commons and spreading its ideology. Even with a low initial balance the reserve ratio is at a healthy amount, this means that as our supply grows we can count of having lower amounts of price slippage

Strong tributes in the beginning will test the resolve of our new revolutionistas and penalize the feeble-willed who abandon our cause early. By having higher tributes we can hope to capture additional funding from the hype train generated by the Commons Upgrade.

Once our revolution is successful and our provisional government is established we can put our Tao Voting parameters to the test by lowering the tributes to healthier economic levels (3, 3). I envision this happening within 3-6 months.

| Parameter | Value |

|---|---|

| Commons Tribute | 70.00% |

| Entry Tribute | 8.00% |

| Exit Tribute | 10.00% |

| *Reserve Ratio | 19.34% |

*This is an output. Learn more about the Reserve Ratio here.

| Allocation of Funds | wxDAI |

|---|---|

| Common Pool (Before Initial Buy) | 882856.50 |

| Reserve (Before Initial Buy) | 378367.07 |

| Common Pool (After Initial Buy) | 902856.50 |

| Reserve (After Initial Buy) | 608367.07 |

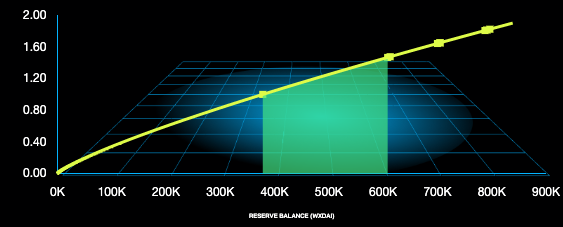

TEC Price vs ABC Reserve Holdings

The ABC mints and burns TEC tokens, the price of the TEC token is dependent on the funds that is held in the Reserve. This graph shows how the ABC’s Price for TEC tokens changes with the ABC’s Reserve Balance. The Initial Buy that will happen at launch is highlighted.

Example Transaction Data

| Tx | Reserve | Total Supply | Price | Amount In | Tribute | Amount Out | New Price | Slippage |

|---|---|---|---|---|---|---|---|---|

| 0 | 378367.07 | 1956421.69 | 1.0 | 250000.00 wxDAI | 20000.0 | 188202.31 TEC | 1.47 | 18.17% |

| 1 | 608367.07 | 2144624.0 | 1.47 | 5000.00 wxDAI | 400.0 | 3126.61 TEC | 1.48 | 0.30% |

| 2 | 612967.07 | 2147750.61 | 1.48 | 100000.00 wxDAI | 8000.0 | 58877.81 TEC | 1.65 | 5.56% |

| 3 | 704967.07 | 2206628.42 | 1.65 | 3000.00 TEC | 395.34 | 4546.39 wxDAI | 1.64 | 0.28% |

| 4 | 700025.34 | 2203628.42 | 1.64 | 5000.00 wxDAI | 400.0 | 2793.09 TEC | 1.65 | 0.26% |

| 5 | 704625.34 | 2206421.51 | 1.65 | 100000.00 wxDAI | 8000.0 | 52992.25 TEC | 1.82 | 4.89% |

| 6 | 796625.34 | 2259413.76 | 1.82 | 3000.00 TEC | 436.33 | 5017.81 wxDAI | 1.81 | 0.28% |

| 7 | 791171.2 | 2256413.76 | 1.81 | 2000.00 TEC | 289.55 | 3329.78 wxDAI | 1.81 | 0.18% |

ABC Overview

| Reserve (wxDai) | Supply (TEC) | Price (wxDai/TEC) | Market cap |

|---|---|---|---|

| 10,000 | 968,981 | 0.05 | 51,717.70 |

| 50,000 | 1,322,758 | 0.20 | 258,545.47 |

| 100,000 | 1,512,506 | 0.34 | 517,080.03 |

| 200,000 | 1,729,477 | 0.60 | 1,034,149.49 |

| 300,000 | 1,870,553 | 0.83 | 1,551,219.10 |

| 400,000 | 1,977,574 | 1.05 | 2,068,289.62 |

| 500,000 | 2,064,785 | 1.25 | 2,585,357.59 |

| 600,000 | 2,138,889 | 1.45 | 3,102,426.15 |

| 700,000 | 2,203,614 | 1.64 | 3,619,495.45 |

| 800,000 | 2,261,263 | 1.83 | 4,136,568.61 |

| 900,000 | 2,313,363 | 2.01 | 4,653,636.67 |

| 1,000,000 | 2,360,984 | 2.19 | 5,170,707.02 |

| 1,250,000 | 2,465,104 | 2.62 | 6,463,380.51 |

| 1,500,000 | 2,553,575 | 3.04 | 7,756,051.99 |

| 1,750,000 | 2,630,850 | 3.44 | 9,048,730.89 |

| 2,000,000 | 2,699,675 | 3.83 | 10,341,405.52 |

| 2,500,000 | 2,818,731 | 4.59 | 12,926,751.69 |

| 3,000,000 | 2,919,894 | 5.31 | 15,512,096.71 |

| 3,500,000 | 3,008,253 | 6.02 | 18,097,449.37 |

| 4,000,000 | 3,086,952 | 6.70 | 20,682,792.17 |

| 5,000,000 | 3,223,087 | 8.02 | 25,853,493.31 |

| 7,500,000 | 3,486,002 | 11.12 | 38,780,218.79 |

| 10,000,000 | 3,685,449 | 14.03 | 51,706,956.23 |

| 15,000,000 | 3,986,081 | 19.46 | 77,560,445.52 |

| 20,000,000 | 4,214,139 | 24.54 | 103,413,904.40 |

| 50,000,000 | 5,031,176 | 51.39 | 258,534,777.65 |

| 100,000,000 | 5,752,915 | 89.88 | 517,069,709.39 |

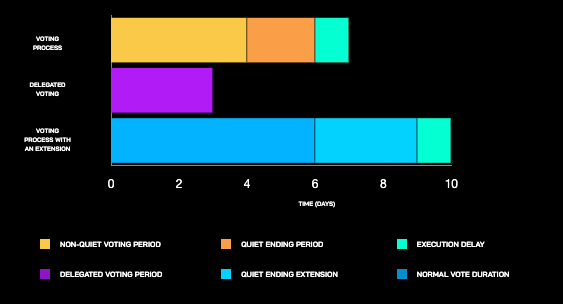

Module 3: Tao Voting

Strategy:

Revolutions need to be agile as well. For this we should aim for high consensus, short-er duration.

Tao Voting might not interest everyone, but that’s why we have delegates. It should be reasonable to expect high turnout for votes since voting power should either be used or delegated, not sitting idle, this is not how revolutions are made!

A quick-er vote duration means we could wrap up and execute votes within one week. If there’s any contention we add ample time for more participation.

A greater execution delay however allows our economy’s participants to react to any potential changes to its configuration before being implemented.

| Parameter | Value |

|---|---|

| Support Required | 88% |

| Minimum Quorum | 8% |

| Vote Duration | 6 day(s) |

| Delegated Voting Period | 3 day(s) |

| Quiet Ending Period | 2 day(s) |

| Quiet Ending Extension | 3 day(s) |

| Execution Delay | 1 day(s) |

Tao Voting Timeline From Proposal To Execution

This shows how the timeline stacks up for yes/no time based votes that can change the configuration after launch.

Timeline Data

| # of Quiet Ending Extensions | No Extensions | With 1 Extension | With 2 Extensions |

|---|---|---|---|

| Time to Vote on Proposals | 6 days | 9 days | 12 days |

| Time to Review a Delegates Vote | 3 days | 6 days | 9 days |

| Time to Execute a Passing Proposal | 7 days | 10 days | 13 days |

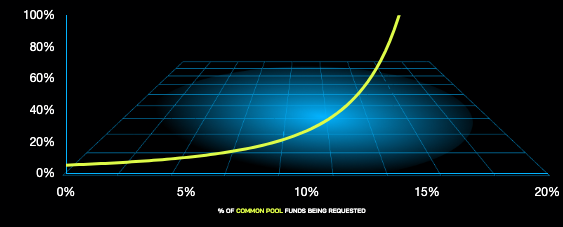

Module 4: Conviction Voting

Strategy:

With these settings we’ll need to optimize voter engagement, even humble requests in the range of 15-35k will need an exceptional amount of tokens staked if we assume to have good engagement from hatchers. this build also protect us adqeuately from small proposals passing under the radar

| Parameter | Value |

|---|---|

| Conviction Growth | 7 day(s) |

| Minimum Conviction | 4.0% |

| Spending Limit | 18.0% |

Minimum Percent of Voting Tokens Needed to Pass Funding Requests

This shows how the minimum percent of tokens needed to pass proposals after 2 weeks varies with the percent of the Common Pool funds being requested.

Example Funding Request Data

| Proposal | Requested Amount (wxDAI) | Common Pool (wxDAI) | Effective supply (TEC) | Tokens Needed To Pass (TEC) |

|---|---|---|---|---|

| 1 | 1,000 | 100,000 | 1,500,000 | 67266 |

| 2 | 5,000 | 100,000 | 1,500,000 | 115029 |

| 3 | 25,000 | 100,000 | 1,500,000 | Not possible |

| 4 | 1,000 | 750,000 | 1,500,000 | 60898 |

| 5 | 5,000 | 750,000 | 1,500,000 | 64704 |

| 6 | 25,000 | 750,000 | 1,500,000 | 90371 |

| 7 | 35,000 | 900,000 | 1,500,000 | 97627 |

| 8 | 15,000 | 900,000 | 1,500,000 | 72869 |

| 9 | 40,000 | 700,000 | 2,000,000 | 171725 |

| 10 | 1,000 | 700,000 | 2,000,000 | 81285 |

FORK THIS PROPOSAL (link)

Parameter Definitions

Token Freeze and Token Thaw

- Token Freeze: 12 weeks, meaning that 100% of TEC tokens minted for Hatchers will remain locked from being sold or transferred for 12 weeks. They can still be used to vote while frozen.

- Token Thaw: 52 weeks, meaning the Hatchers frozen tokens will start to become transferable at a steady rate starting at the end of Token Freeze and ending 52 weeks later.

- Opening Price: 1 wxDAI, meaning for the initial buy, the first TEC minted by the Augmented Bonding Curve will be priced at 1 wxDAI making it the price floor during the Token Freeze.

Augmented Bonding Curve (ABC)

- Commons Tribute: 70.00%, which means that 70.00% of the Hatch funds (882856.50 wxDAI) will go to the Common Pool and 30.00% (378367.07 wxDAI) will go to the ABC’s Reserve.

- Entry Tribute: 8.00% meaning that from every BUY order on the ABC, 8.00% of the order value in wxDAI is subtracted and sent to the Common Pool.

- Exit Tribute: 10.00% meaning that from every SELL order on the ABC, 10.00% of the order value in wxDAI is subtracted and sent to the Common Pool.

Tao Voting

- Support Required: 88%, which means 88% of all votes must be in favor of a proposal for it to pass.

- Minimum Quorum: 8%, meaning that 8% of all tokens need to have voted on a proposal in order for it to become valid.

- Vote Duration: 6 day(s), meaning that eligible voters will have 6 day(s) to vote on a proposal.

- Delegated Voting Period is set for 3 day(s), meaning that Delegates will have 3 day(s) to use their delegated voting power to vote on a proposal.

- Quiet Ending Period: 2 day(s), this means that 2 day(s) before the end of the Vote Duration, if the vote outcome changes, the Quiet Ending Extension will be triggered.

- Quiet Ending Extension: 3 day(s), meaning that if the vote outcome changes during the Quiet Ending Period, an additional 3 day(s) will be added for voting.

- Execution Delay: 1 day(s), meaning that there is an 1 day delay after the vote is passed before the proposed action is executed.

Conviction Voting

- Conviction Growth: 7 day(s), meaning that voting power will increase by 50% every 7 days that they are staked behind a proposal, so after 12 days, a voters voting power will have reached 75% of it’s maximum capacity.

- Minimum Conviction: 4.0%, this means that to pass any funding request it will take at least 4.0% of the actively voting TEC tokens.

- The Spending Limit: 18.0%, which means that no more than 18.0% of the total funds in the Common Pool can be funded by a single proposal.

Advanced Settings*

| Parameter | Value |

|---|---|

| HNY Liquidity | 100 wxDAI |

| Garden Liquidity | 1 TEC |

| Virtual Supply | 1 TEC |

| Virtual Balance | 1 wxDAI |

| Transferable | True |

| Token Name | Token Engineering Commons |

| Token Symbol | TEC |

| Proposal Deposit | 200 wxDAI |

| Challenge Deposit | 400 wxDAI |

| Settlement Period | 5 days |

| Minimum Effective Supply | 1.0% |

| Hatchers Rage Quit | 60000 wxDAI |

| Initial Buy | 250000 wxDAI |