Disclaimer: I did not write this proposal, @Tamara did? I am posting the proposal text here to raise awareness and hopefully to drum up some support.

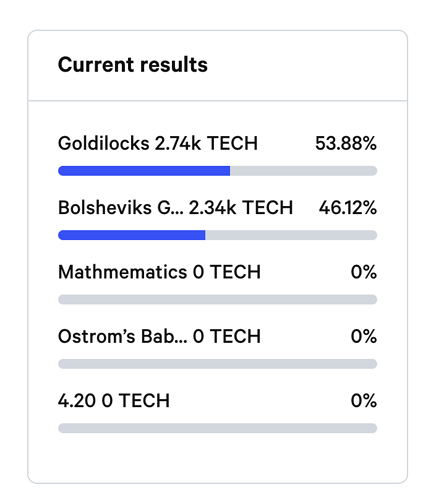

What is the overall Commons Configuration strategy?

Based on Sunday’s debates and, in particular, feedback from PaulH, PhilH, Simon de la Rouviere and Decentralized SDGs I am incorporating new thinking about the params into the original proposal.

Here are the main points:

Hatchers are in this for the long term. I am not changing the Freeze & Thaw of 39 and 65. With the other changes, the floor will remain above the Hatcher price of 1wxdai for 1.5 years, so that floor was even extended.

Opening price upped to 2.71. The challenge was to balance sufficiently funding the Common Pool without torpedoing the Reserve Ratio at a higher opening.

The “public” opening price (after the TEC’s initial-buy) will be 4.20 and that is a meme everyone loves.

Letting go of the 1M target for the Commons Pool. But we will have 927K available on day 1 so it is also not that far off.

The Reserve Ratio is 7.14% but that’s the tradeoff I made for a higher opening price.

I am removing the idea of step-changing tributes. First of all, there is no way to ensure it will happen. It is an unenforceable element in any proposal. Token holders will be different at the time the votes happen. That token holders will lower the entry tribute and RAISE the exit tribute (directly affecting their token holdings) is too wishful thinking even if it is has logical merit. If the community decided to do that, great, but we can’t bank on it.

Setting the Entry and Exit to 12 and 8 which feels like the right balance to start with and the community can evaluate the results over the first months to determine whether or not we will want to change them.

Changing the TAO voting after seeing the value of having a slightly lower support required and quorum. I also took 1 day off the vote duration. Let’s not hinder ourselves by making votes too hard to pass. At 77% support required, it would take 23% no votes to block a change to the DAO. Its not so much that it will divide the community and no so little that it could happen often.

Standing by the params in CV. I’d like to see ambitious projects with proved leadership and teams get funded. With Hatcher tokens frozen we make up the lions share of voters. We know the reputation of those that will be proposing for funding. We know who delivers.

Allowing funding votes to pass in less than one day is a terrible disservice to our global community. Every TEC token holder should have the chance to see a proposal in their daytime hours.

Did you know that from hatching to leaving the nest a bird can increase its weight by as much as 10 times?

Influenced and inspired by:

#113 - “The Fledge”

#74 - $1 Gambit for $1,000,000 Goldilocks Orogeny

#109 - The Bolshevik’s Gambit fork with Revolutionary Opening Price and Iron Curtain Conviction Voting

#124 - Montaña Rusa: The Communist Roller-Coaster

FORK THIS PROPOSAL (link)

Summary

Module 1: Token Freeze & Token Thaw

| Parameter | Value |

|---|---|

| Token Freeze | 39 Weeks |

| Token Thaw | 65 Weeks |

| Opening Price | 2.71 wxDAI |

Module 2: Augmented Bonding Curve

| Parameter | Value |

|---|---|

| Commons Tribute | 70.00% |

| Entry Tribute | 12.00% |

| Exit Tribute | 8.00% |

| *Reserve Ratio | 7.14% |

*This is an output. Learn more about the Reserve Ratio here.

Module 3: Tao Voting

| Parameter | Value |

|---|---|

| Support Required | 77% |

| Minimum Quorum | 7% |

| Vote Duration | 5 day(s) |

| Delegated Voting Period | 3 day(s) |

| Quiet Ending Period | 2 day(s) |

| Quiet Ending Extension | 3 day(s) |

| Execution Delay | 1 day(s) |

Module 4: Conviction Voting

| Parameter | Value |

|---|---|

| Conviction Growth | 14 day(s) |

| Minimum Conviction | 5.0% |

| Spending Limit | 20.0% |

Module 1: Token Freeze and Token Thaw

Strategy:

Hatchers are in this for the long term. I am not changing the Freeze & Thaw of 39 and 65. With the other changes, the floor will remain above the Hatcher price of 1wxdai for 1.5 years, so that floor was even extended.

In large part, our Hatch was based on the premise that Hatchers are commitment the long term, mission driven goals over short term individual gains. So I’m advocating for a longish thaw. One that will give the TEC a floor above the Hatch price for the entire first year. Kudos to The Fledge (#113) for the “hatch, fledge” analogy. Hatch, fledge, fly!

Did you know that from hatching to leaving the nest a bird can increase its weight by as much as 10 times?

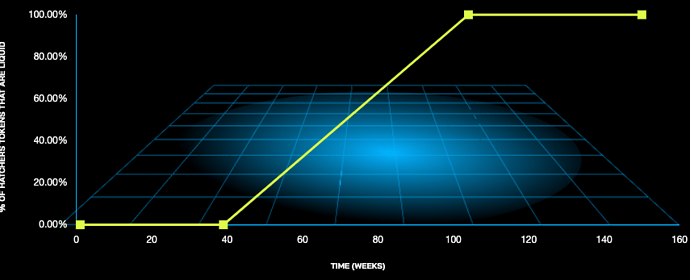

With the freeze/thaw at 39/65, Hatchers tokens begin to thaw at 9 months and by the end of the first year, 20% of Hatchers tokens will be unfrozen.

We are not greedy. We envision a world where ethical and resilient economic systems benefit societies. We know it will take us time to make that happen and that having a secure floor for one full yer will provide needed security to take our next bold steps. This gives us a year to build our reputation, strategies and agility in whatever market conditions we face.

| Parameter | Value |

|---|---|

| Token Freeze | 39 Weeks |

| Token Thaw | 65 Weeks |

| Opening Price | 2.71 wxDAI |

Hatcher’s TEC Release Schedule

This is the release schedule for TEC that was given to Hatchers. Their TEC will start out frozen and then slowly become liquid according to the graph above.

Token Release Timeline

| Duration | % of Tokens Released | Price Floor of Token |

|---|---|---|

| 3 months | 0.00% | 2.71 wxDAI |

| 6 months | 0.00% | 2.71 wxDAI |

| 9 months | 0.00% | 2.71 wxDAI |

| 1 year | 20.00% | 2.17 wxDAI |

| 1.5 years | 60.00% | 1.08 wxDAI |

| 2 years | 100.00% | 0.00 wxDAI |

| 3 years | 100.00% | 0.00 wxDAI |

| 4 years | 100.00% | 0.00 wxDAI |

| 5 years | 100.00% | 0.00 wxDAI |

Module 2: Augmented Bonding Curve (ABC)

Strategy:

- Opening price upped to 2.71. The challenge was to balance sufficiently funding the Common Pool without torpedoing the Reserve Ratio at a higher opening.

- The “public” opening price (after the TEC’s initial-buy) will be 4.20 and that is a meme everyone loves.

- Letting go of the 1M target for the Commons Pool. But we will have 927K available on day 1 so it is also not that far off.

- The Reserve Ratio is 7.14% but that’s the tradeoff I made for a higher opening price.

- I am removing the idea of step-changing tributes. First of all, there is no way to ensure it will happen. It is an unenforceable element in any proposal. Token holders will be different at the time the votes happen. That token holders will lower the entry tribute and RAISE the exit tribute (directly affecting their token holdings) is too wishful thinking even if it is has logical merit. If the community decided to do that, great, but we can’t bank on it.

- Setting the Entry and Exit to 12 and 8 which feels like the right balance to start with and the community can evaluate the results over the first months to determine whether or not we will want to change them.

----- made some updates to the below —

The psychological impact of 1M in the Commons pool is no small trifle. That’s 1M allocated directly to funding proposals that serve our mission. With a must-have of 1M in the Commons pool, I looked to find the right balance between the Commons Tribute (sourced from existing Hatchers) and Entry/Exit Tribute (to be sourced from future TEC token holders).

Unless we are setting the entry/exit to near-zero we should expect that future TEC token holders are here for the impact to be made and a belief in what we are doing. Any non-zero tribute will be a deterrent to the average speculator.

Here I nod again to #113 and appreciate very much their doubling down on the impact investment angle. In their words: “The 80% initial tribute makes us unabashedly an impact investment. Impact investors care about impact and don’t want to pay to fund reserves to lower the volatility. Another effect of the low reserve is high slippage, which makes it expensive and thus unattractive for non-aligned, purely speculative whales to suddenly buy up large shares in ways that might harm the mission and the community. Impact investors will care less about slippage, since that money goes to the TEC, which they are backing for impact. Oh, did I mention it’s a million dollar fund. Nice.

Yeah, 30% entry tribute is a big cut. But remember, we’re an impact investment. We pitch that the 30% is an investment that they make in public goods and we take it off the top while they’re still excited. There’s no exit tribute. We get the investment up front, not when they’re trying to get out and may have reasons for leaving anyway.”

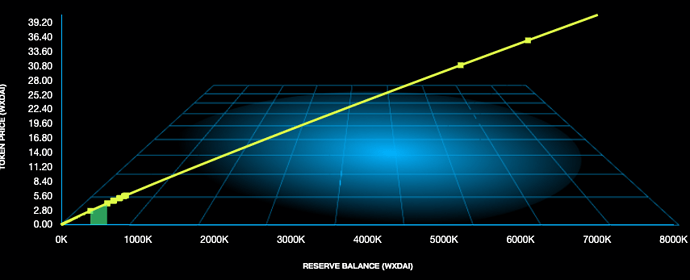

| Parameter | Value |

|---|---|

| Commons Tribute | 70.00% |

| Entry Tribute | 12.00% |

| Exit Tribute | 8.00% |

| *Reserve Ratio | 7.14% |

*This is an output. Learn more about the Reserve Ratio here.

| Allocation of Funds | wxDAI |

|---|---|

| Common Pool (Before Initial Buy) | 882856.50 |

| Reserve (Before Initial Buy) | 378367.07 |

| Common Pool (After Initial Buy) | 912856.50 |

| Reserve (After Initial Buy) | 598367.07 |

TEC Price vs ABC Reserve Holdings

The ABC mints and burns TEC tokens, the price of the TEC token is dependent on the funds that is held in the Reserve. This graph shows how the ABC’s Price for TEC tokens changes with the ABC’s Reserve Balance. The Initial Buy that will happen at launch is highlighted.

Example Transaction Data

| Tx | Reserve | Total Supply | Price | Amount In | Tribute | Amount Out | New Price | Slippage |

|---|---|---|---|---|---|---|---|---|

| 0 | 378367.07 | 1956421.69 | 2.71 | 250000.00 wxDAI | 30000.0 | 65050.92 TEC | 4.15 | 19.87% |

| 1 | 598367.07 | 2021472.61 | 4.15 | 5000.00 wxDAI | 600.0 | 1057.20 TEC | 4.18 | 0.34% |

| 2 | 602767.07 | 2022529.81 | 4.18 | 100000.00 wxDAI | 12000.0 | 19764.97 TEC | 4.74 | 6.20% |

| 3 | 690767.07 | 2042294.77 | 4.74 | 3000.00 TEC | 1690.01 | 12393.37 wxDAI | 4.65 | 0.95% |

| 4 | 676683.7 | 2039294.77 | 4.65 | 5000.00 wxDAI | 600.0 | 943.45 TEC | 4.68 | 0.30% |

| 5 | 681083.7 | 2040238.23 | 4.68 | 100000.00 wxDAI | 12000.0 | 17769.51 TEC | 5.24 | 5.54% |

| 6 | 769083.7 | 2058007.73 | 5.24 | 3000.00 TEC | 1867.38 | 13694.13 wxDAI | 5.14 | 0.94% |

| 7 | 753522.18 | 2055007.73 | 5.14 | 5000.00 wxDAI | 600.0 | 854.04 TEC | 5.17 | 0.27% |

| 8 | 757922.18 | 2055861.77 | 5.17 | 100000.00 wxDAI | 12000.0 | 16179.52 TEC | 5.72 | 5.02% |

| 9 | 845922.18 | 2072041.29 | 5.72 | 3000.00 TEC | 2040.17 | 14961.24 wxDAI | 5.61 | 0.94% |

| 10 | 828920.77 | 2069041.29 | 5.61 | 2000.00 TEC | 1338.89 | 9818.51 wxDAI | 5.54 | 0.63% |

| 11 | 817763.37 | 2067041.29 | 5.54 | 5000000.00 wxDAI | 600000.0 | 292280.96 TEC | 30.99 | 63.17% |

| 12 | 5217763.37 | 2359322.25 | 30.99 | 1000000.00 wxDAI | 120000.0 | 26387.73 TEC | 35.82 | 7.07% |

ABC Overview

| Reserve (wxDai) | Supply (TEC) | Price (wxDai/TEC) | Market cap |

|---|---|---|---|

| 10,000 | 1,509,647 | 0.09 | 140,215.88 |

| 50,000 | 1,693,328 | 0.41 | 700,717.39 |

| 100,000 | 1,779,188 | 0.79 | 1,401,337.53 |

| 200,000 | 1,869,407 | 1.50 | 2,802,599.59 |

| 300,000 | 1,924,287 | 2.18 | 4,203,835.30 |

| 400,000 | 1,964,202 | 2.85 | 5,605,101.51 |

| 500,000 | 1,995,730 | 3.51 | 7,006,338.08 |

| 600,000 | 2,021,866 | 4.16 | 8,407,590.33 |

| 700,000 | 2,044,232 | 4.80 | 9,808,899.10 |

| 800,000 | 2,063,805 | 5.43 | 11,210,133.66 |

| 900,000 | 2,081,225 | 6.06 | 12,611,371.42 |

| 1,000,000 | 2,096,932 | 6.68 | 14,012,571.13 |

| 1,250,000 | 2,130,593 | 8.22 | 17,515,772.60 |

| 1,500,000 | 2,158,494 | 9.74 | 21,018,781.81 |

| 1,750,000 | 2,182,372 | 11.24 | 24,522,045.83 |

| 2,000,000 | 2,203,268 | 12.72 | 28,025,192.01 |

| 2,500,000 | 2,238,634 | 15.65 | 35,031,353.26 |

| 3,000,000 | 2,267,952 | 18.54 | 42,037,674.20 |

| 3,500,000 | 2,293,038 | 21.39 | 49,043,732.00 |

| 4,000,000 | 2,314,995 | 24.21 | 56,050,448.82 |

| 5,000,000 | 2,352,155 | 29.79 | 70,062,628.97 |

| 7,500,000 | 2,421,211 | 43.41 | 105,094,427.65 |

| 10,000,000 | 2,471,433 | 56.70 | 140,125,702.74 |

| 15,000,000 | 2,543,990 | 82.62 | 210,188,288.63 |

| 20,000,000 | 2,596,758 | 107.92 | 280,250,674.56 |

| 50,000,000 | 2,772,237 | 252.73 | 700,629,155.30 |

| 100,000,000 | 2,912,816 | 481.06 | 1,401,252,752.99 |

Module 3: Tao Voting

Strategy:

PhilH challenged this the first time I shared it in a debate and I appreciate that. It made me think again and see the value of having a slightly lower support required and quorum. I also took 1 day off the vote duration.

Changing the TAO voting after seeing the value of having a slightly lower support required and quorum. I also took 1 day off the vote duration. Let’s not hinder ourselves by making votes too hard to pass. At 77% support required, it would take 23% no votes to block a change to the DAO. It’s not so much that it will divide the community and no so little that it could happen often.

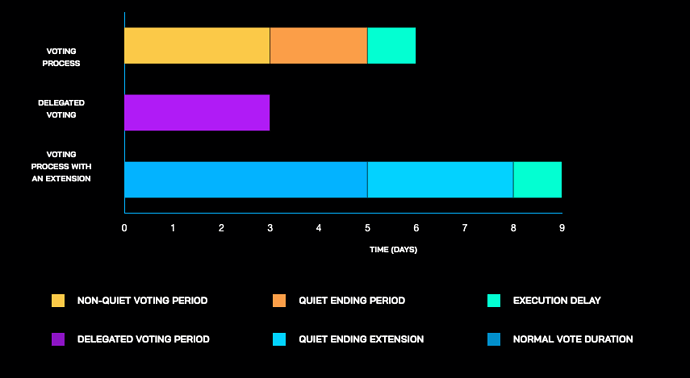

| Parameter | Value |

|---|---|

| Support Required | 77% |

| Minimum Quorum | 7% |

| Vote Duration | 5 day(s) |

| Delegated Voting Period | 3 day(s) |

| Quiet Ending Period | 2 day(s) |

| Quiet Ending Extension | 3 day(s) |

| Execution Delay | 1 day(s) |

Tao Voting Timeline From Proposal To Execution

This shows how the timeline stacks up for yes/no time based votes that can change the configuration after launch.

Timeline Data

| # of Quiet Ending Extensions | No Extensions | With 1 Extension | With 2 Extensions |

|---|---|---|---|

| Time to Vote on Proposals | 5 days | 8 days | 11 days |

| Time to Review a Delegates Vote | 2 days | 5 days | 8 days |

| Time to Execute a Passing Proposal | 6 days | 9 days | 12 days |

Module 4: Conviction Voting

Strategy:

There is a conversation about the TE Academy proposal that shapes my thinking here. Knowing their longer financial runway facilitates funding roles to execute their vision. So, for example, requesting a grant for 6 months out versus month-by-month would be the difference between only being able to assure someone’s role month-to-month versus offering a longer term assurance of compensation to a new hire. This is big for our bootstrapping projects!

Low spending limits act as a sort of check-and-balance on projects as they will need to prove continuous delivery by requesting small amounts periodically. There is a real advantage to that but I feel that makes it administratively difficult for larger, more ambitious projects like the TE Academy to depend on funding from us. And for the voters, it will exhaust our attention to have a constant stream of smaller proposals.

High spending limits here might pose a risk but as #124 points out, we have Celeste. We should be able to rely on Celeste to arbitrate anyone acting in bad faith. In the end, I believe it will better serve our goal of advancing Token Engineering than a low spending limit.

Finally, that any proposal will require > 24 hours to pass is a courtesy to the entire community.

| Parameter | Value |

|---|---|

| Conviction Growth | 14 day(s) |

| Minimum Conviction | 5.0% |

| Spending Limit | 20.0% |

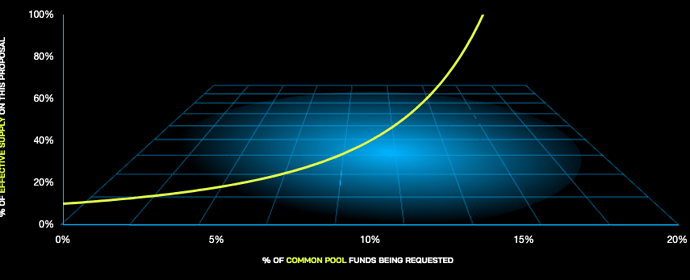

Minimum Percent of Voting Tokens Needed to Pass Funding Requests

This shows how the minimum percent of tokens needed to pass proposals after 2 weeks varies with the percent of the Common Pool funds being requested.

Example Funding Request Data

| Proposal | Requested Amount (wxDAI) | Common Pool (wxDAI) | Effective supply (TEC) | Tokens Needed To Pass (TEC) |

|---|---|---|---|---|

| 1 | 1,000 | 100,000 | 1,500,000 | 83102 |

| 2 | 5,000 | 100,000 | 1,500,000 | 133333 |

| 3 | 25,000 | 100,000 | 1,500,000 | Not possible |

| 4 | 1,000 | 750,000 | 1,500,000 | 76010 |

| 5 | 5,000 | 750,000 | 1,500,000 | 80261 |

| 6 | 25,000 | 750,000 | 1,500,000 | 108000 |

| 7 | 150,000 | 865,213 | 1,500,000 | Not possible |

FORK THIS PROPOSAL (link)

Parameter Definitions

Token Freeze and Token Thaw

- Token Freeze: 39 weeks, meaning that 100% of TEC tokens minted for Hatchers will remain locked from being sold or transferred for 39 weeks. They can still be used to vote while frozen.

- Token Thaw: 65 weeks, meaning the Hatchers frozen tokens will start to become transferable at a steady rate starting at the end of Token Freeze and ending 65 weeks later.

- Opening Price: 2.71 wxDAI, meaning for the initial buy, the first TEC minted by the Augmented Bonding Curve will be priced at 2.71 wxDAI making it the price floor during the Token Freeze.

Augmented Bonding Curve (ABC)

- Commons Tribute: 70.00%, which means that 70.00% of the Hatch funds (882856.50 wxDAI) will go to the Common Pool and 30.00% (378367.07 wxDAI) will go to the ABC’s Reserve.

- Entry Tribute: 12.00% meaning that from every BUY order on the ABC, 12.00% of the order value in wxDAI is subtracted and sent to the Common Pool.

- Exit Tribute: 8.00% meaning that from every SELL order on the ABC, 8.00% of the order value in wxDAI is subtracted and sent to the Common Pool.

Tao Voting

- Support Required: 77%, which means 77% of all votes must be in favor of a proposal for it to pass.

- Minimum Quorum: 7%, meaning that 7% of all tokens need to have voted on a proposal in order for it to become valid.

- Vote Duration: 5 day(s), meaning that eligible voters will have 5 day(s) to vote on a proposal.

- Delegated Voting Period is set for 3 day(s), meaning that Delegates will have 3 day(s) to use their delegated voting power to vote on a proposal.

- Quiet Ending Period: 2 day(s), this means that 2 day(s) before the end of the Vote Duration, if the vote outcome changes, the Quiet Ending Extension will be triggered.

- Quiet Ending Extension: 3 day(s), meaning that if the vote outcome changes during the Quiet Ending Period, an additional 3 day(s) will be added for voting.

- Execution Delay: 1 day(s), meaning that there is an 1 day delay after the vote is passed before the proposed action is executed.

Conviction Voting

- Conviction Growth: 14 day(s), meaning that voting power will increase by 50% every 14 days that they are staked behind a proposal, so after 10 days, a voters voting power will have reached 75% of it’s maximum capacity.

- Minimum Conviction: 5.0%, this means that to pass any funding request it will take at least 5.0% of the actively voting TEC tokens.

- The Spending Limit: 20.0%, which means that no more than 20.0% of the total funds in the Common Pool can be funded by a single proposal.

Advanced Settings*

| Parameter | Value |

|---|---|

| HNY Liquidity | 100 wxDAI |

| Garden Liquidity | 1 TEC |

| Virtual Supply | 1 TEC |

| Virtual Balance | 1 wxDAI |

| Transferable | True |

| Token Name | Token Engineering Commons |

| Token Symbol | TEC |

| Proposal Deposit | 200 wxDAI |

| Challenge Deposit | 400 wxDAI |

| Settlement Period | 5 days |

| Minimum Effective Supply | 1.0% |

| Hatchers Rage Quit | 60000 wxDAI |

| Initial Buy | 250000 wxDAI |

*Learn more about Advanced Settings on the TEC forum