Ostrom’s $1,000,000 Hatch, Fledge & Fly! Now slightly damped at the extremes producing a viable and balanced proposal. Only softened about 6 variables from the original "Ostrom’s $1,000,000 Hatch, Fledge & Fly!"

Folks after listening to Sunday’s debates I tried to create a balanced set of proposals. It is #136 in Github.

I simple forked the proposal called “Ostrom’s $1,000,000 Hatch, Fledge & Fly” and I dampened 6 of the most extreme variables. Changes have been stated inside square brackets ( [fafsa]). I believe this results in a balanced and conservative set of params that should be considered by the TEC. Here are the simple changes I made:

[reduced token thaw to from 65 to 52 weeks]

[dropped CT to from 73 to 55 and the Entry and exits got dropped a lot-we don’t want to disincentivize trading]

[dropped S.Limit from 20 to 10. Dropped CG from 14-10]

Increased Support Required from 77% to 88%. Increased min quorum to 8 (from 7).

That is all. Everything else is forked from the “Ostrom’s…”

This set of params should keep our community thriving. Please support me with a vote on TokenLog.

https://tokenlog.xyz/CommonsBuild/commons-config-proposals (it is new so scroll down).

Module 1: Token Freeze & Token Thaw

| Parameter | Value |

|---|---|

| Token Freeze | 39 Weeks |

| Token Thaw | 52 Weeks |

| Opening Price | 1.5 wxDAI |

Module 2: Augmented Bonding Curve

| Parameter | Value |

|---|---|

| Commons Tribute | 55.00% |

| Entry Tribute | 3.00% |

| Exit Tribute | 5.00% |

| *Reserve Ratio | 19.34% |

*This is an output. Learn more about the Reserve Ratio here.

Module 3: Tao Voting

| Parameter | Value |

|---|---|

| Support Required | 88% |

| Minimum Quorum | 8% |

| Vote Duration | 6 day(s) |

| Delegated Voting Period | 3 day(s) |

| Quiet Ending Period | 2 day(s) |

| Quiet Ending Extension | 3 day(s) |

| Execution Delay | 1 day(s) |

Module 4: Conviction Voting

| Parameter | Value |

|---|---|

| Conviction Growth | 10 day(s) |

| Minimum Conviction | 5.0% |

| Spending Limit | 10.0% |

Module 1: Token Freeze and Token Thaw

Strategy:

In large part, our Hatch was based on the premise that Hatchers are commitment the long term, mission driven goals over short term individual gains. So I’m advocating for a longish thaw. One that will give the TEC a floor above the Hatch price for the entire first year. Kudos to The Fledge (#113) for the “hatch, fledge” analogy. Hatch, fledge, fly!

Did you know that from hatching to leaving the nest a bird can increase its weight by as much as 10 times?

With the freeze/thaw at 39/65, Hatchers tokens begin to thaw at 9 months and by the end of the first year, 20% of Hatchers tokens will be unfrozen.

We are not greedy. We envision a world where ethical and resilient economic systems benefit societies. We know it will take us time to make that happen and that having a secure floor for one full yer will provide needed security to take our next bold steps. This gives us a year to build our reputation, strategies and agility in whatever market conditions we face.

[reduced token thaw to from 65 to 52 weeks]

| Parameter | Value |

|---|---|

| Token Freeze | 39 Weeks |

| Token Thaw | 52 Weeks |

| Opening Price | 1.5 wxDAI |

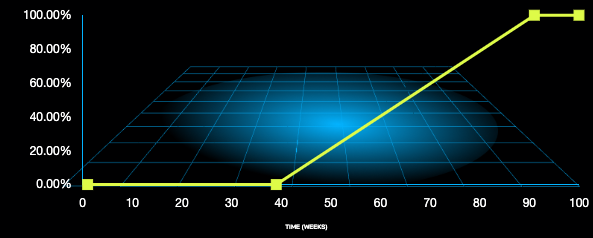

Hatcher’s TEC Release Schedule

This is the release schedule for TEC that was given to Hatchers. Their TEC will start out frozen and then slowly become liquid according to the graph above.

Token Release Timeline

| Duration | % of Tokens Released | Price Floor of Token |

|---|---|---|

| 3 months | 0.00% | 1.50 wxDAI |

| 6 months | 0.00% | 1.50 wxDAI |

| 9 months | 0.00% | 1.50 wxDAI |

| 1 year | 25.00% | 1.12 wxDAI |

| 1.5 years | 75.00% | 0.38 wxDAI |

| 2 years | 100.00% | 0.00 wxDAI |

| 3 years | 100.00% | 0.00 wxDAI |

| 4 years | 100.00% | 0.00 wxDAI |

| 5 years | 100.00% | 0.00 wxDAI |

Module 2: Augmented Bonding Curve (ABC)

Strategy:

The psychological impact of 1M in the Commons pool is no small trifle. That’s 1M allocated directly to funding proposals that serve our mission. With a must-have of 1M in the Commons pool, I looked to find the right balance between the Commons Tribute (sourced from existing Hatchers) and Entry/Exit Tribute (to be sourced from future TEC token holders).

Unless we are setting the entry/exit to near-zero we should expect that future TEC token holders are here for the impact to be made and a belief in what we are doing. Any non-zero tribute will be a deterrent to the average speculator.

I see the wisdom of #74 with having the entry/exit adjust over a scheduled amount of time and will propose the same. Entry: 16 - 12 - 8 - 4 and Exit: 5 - 6 - 7 - 8, with and adjustment happening every 6 weeks.

In the words of #74 “With this strategy, we should change the Tributes every month so that they gradually go from 22% and 2% to 2% and 12% in 5 months. This could be done every month by decreasing the Entry Tribute by 4% and increasing the Exit Tribute by 2%. This is important for our long term growth so that if the price is going down, more money is flowing into the Common Pool so that as a community we can provide more value to our token holders and the TE community.”

Here I nod again to #113 and appreciate very much their doubling down on the impact investment angle. In their words: “The 80% initial tribute makes us unabashedly an impact investment. Impact investors care about impact and don’t want to pay to fund reserves to lower the volatility. Another effect of the low reserve is high slippage, which makes it expensive and thus unattractive for non-aligned, purely speculative whales to suddenly buy up large shares in ways that might harm the mission and the community. Impact investors will care less about slippage, since that money goes to the TEC, which they are backing for impact. Oh, did I mention it’s a million dollar fund. Nice.

Yeah, 30% entry tribute is a big cut. But remember, we’re an impact investment. We pitch that the 30% is an investment that they make in public goods and we take it off the top while they’re still excited. There’s no exit tribute. We get the investment up front, not when they’re trying to get out and may have reasons for leaving anyway.”

[dropped CT to from 73 to 55 and the Entry and exits got dropped a lot-we don’t want to disincentivize trading]

| Parameter | Value |

|---|---|

| Commons Tribute | 55.00% |

| Entry Tribute | 3.00% |

| Exit Tribute | 5.00% |

| *Reserve Ratio | 19.34% |

*This is an output. Learn more about the Reserve Ratio here.

| Allocation of Funds | wxDAI |

|---|---|

| Common Pool (Before Initial Buy) | 693672.96 |

| Reserve (Before Initial Buy) | 567550.61 |

| Common Pool (After Initial Buy) | 701172.96 |

| Reserve (After Initial Buy) | 810050.61 |

Module 1: Token Freeze & Token Thaw

| Parameter | Value |

|---|---|

| Token Freeze | 39 Weeks |

| Token Thaw | 52 Weeks |

| Opening Price | 1.5 wxDAI |

Module 2: Augmented Bonding Curve

| Parameter | Value |

|---|---|

| Commons Tribute | 55.00% |

| Entry Tribute | 3.00% |

| Exit Tribute | 5.00% |

| *Reserve Ratio | 19.34% |

*This is an output. Learn more about the Reserve Ratio here.

Module 3: Tao Voting

| Parameter | Value |

|---|---|

| Support Required | 88% |

| Minimum Quorum | 8% |

| Vote Duration | 6 day(s) |

| Delegated Voting Period | 3 day(s) |

| Quiet Ending Period | 2 day(s) |

| Quiet Ending Extension | 3 day(s) |

| Execution Delay | 1 day(s) |

Module 4: Conviction Voting

| Parameter | Value |

|---|---|

| Conviction Growth | 10 day(s) |

| Minimum Conviction | 5.0% |

| Spending Limit | 10.0% |

Module 1: Token Freeze and Token Thaw

Strategy:

In large part, our Hatch was based on the premise that Hatchers are commitment the long term, mission driven goals over short term individual gains. So I’m advocating for a longish thaw. One that will give the TEC a floor above the Hatch price for the entire first year. Kudos to The Fledge (#113) for the “hatch, fledge” analogy. Hatch, fledge, fly!

Did you know that from hatching to leaving the nest a bird can increase its weight by as much as 10 times?

With the freeze/thaw at 39/65, Hatchers tokens begin to thaw at 9 months and by the end of the first year, 20% of Hatchers tokens will be unfrozen.

We are not greedy. We envision a world where ethical and resilient economic systems benefit societies. We know it will take us time to make that happen and that having a secure floor for one full yer will provide needed security to take our next bold steps. This gives us a year to build our reputation, strategies and agility in whatever market conditions we face.

[reduced token thaw to from 65 to 52 weeks]

| Parameter | Value |

|---|---|

| Token Freeze | 39 Weeks |

| Token Thaw | 52 Weeks |

| Opening Price | 1.5 wxDAI |

Hatcher’s TEC Release Schedule

This is the release schedule for TEC that was given to Hatchers. Their TEC will start out frozen and then slowly become liquid according to the graph above.

Token Release Timeline

| Duration | % of Tokens Released | Price Floor of Token |

|---|---|---|

| 3 months | 0.00% | 1.50 wxDAI |

| 6 months | 0.00% | 1.50 wxDAI |

| 9 months | 0.00% | 1.50 wxDAI |

| 1 year | 25.00% | 1.12 wxDAI |

| 1.5 years | 75.00% | 0.38 wxDAI |

| 2 years | 100.00% | 0.00 wxDAI |

| 3 years | 100.00% | 0.00 wxDAI |

| 4 years | 100.00% | 0.00 wxDAI |

| 5 years | 100.00% | 0.00 wxDAI |

Module 2: Augmented Bonding Curve (ABC)

Strategy:

The psychological impact of 1M in the Commons pool is no small trifle. That’s 1M allocated directly to funding proposals that serve our mission. With a must-have of 1M in the Commons pool, I looked to find the right balance between the Commons Tribute (sourced from existing Hatchers) and Entry/Exit Tribute (to be sourced from future TEC token holders).

Unless we are setting the entry/exit to near-zero we should expect that future TEC token holders are here for the impact to be made and a belief in what we are doing. Any non-zero tribute will be a deterrent to the average speculator.

I see the wisdom of #74 with having the entry/exit adjust over a scheduled amount of time and will propose the same. Entry: 16 - 12 - 8 - 4 and Exit: 5 - 6 - 7 - 8, with and adjustment happening every 6 weeks.

In the words of #74 “With this strategy, we should change the Tributes every month so that they gradually go from 22% and 2% to 2% and 12% in 5 months. This could be done every month by decreasing the Entry Tribute by 4% and increasing the Exit Tribute by 2%. This is important for our long term growth so that if the price is going down, more money is flowing into the Common Pool so that as a community we can provide more value to our token holders and the TE community.”

Here I nod again to #113 and appreciate very much their doubling down on the impact investment angle. In their words: “The 80% initial tribute makes us unabashedly an impact investment. Impact investors care about impact and don’t want to pay to fund reserves to lower the volatility. Another effect of the low reserve is high slippage, which makes it expensive and thus unattractive for non-aligned, purely speculative whales to suddenly buy up large shares in ways that might harm the mission and the community. Impact investors will care less about slippage, since that money goes to the TEC, which they are backing for impact. Oh, did I mention it’s a million dollar fund. Nice.

Yeah, 30% entry tribute is a big cut. But remember, we’re an impact investment. We pitch that the 30% is an investment that they make in public goods and we take it off the top while they’re still excited. There’s no exit tribute. We get the investment up front, not when they’re trying to get out and may have reasons for leaving anyway.”

[dropped CT to from 73 to 55 and the Entry and exits got dropped a lot-we don’t want to disincentivize trading]

| Parameter | Value |

|---|---|

| Commons Tribute | 55.00% |

| Entry Tribute | 3.00% |

| Exit Tribute | 5.00% |

| *Reserve Ratio | 19.34% |

*This is an output. Learn more about the Reserve Ratio here.

| Allocation of Funds | wxDAI |

|---|---|

| Common Pool (Before Initial Buy) | 693672.96 |

| Reserve (Before Initial Buy) | 567550.61 |

| Common Pool (After Initial Buy) | 701172.96 |

| Reserve (After Initial Buy) | 810050.61 |

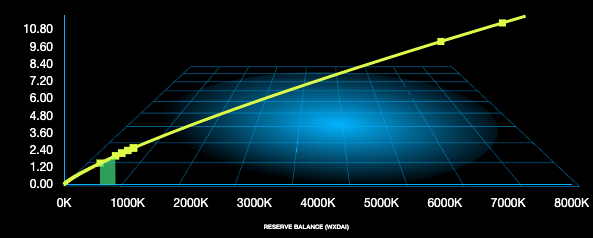

TEC Price vs ABC Reserve Holdings

The ABC mints and burns TEC tokens, the price of the TEC token is dependent on the funds that is held in the Reserve. This graph shows how the ABC’s Price for TEC tokens changes with the ABC’s Reserve Balance. The Initial Buy that will happen at launch is highlighted.