Mathmematics V4 back to the (square) roots, but still with 1 MEMILLION COMMON POOL - Issue 138

What is the overall Commons Configuration strategy?

FINAL V4 UPDATE: This revision returns to the original 13+7 spending limit, but with a conviction growth of 7 and a minimum quorum of 6 to counterbalance.

UPDATE FOR V3: Further numerological research revealed that adjusting the initial price to 0.70 and rising the commons tribute to 7 * 12 (therefore adequately courting the number 13 ) allows us to keep this proposal as perfect as it already is and still launch with a common pool of 1 million, to start the TEC off with proper strength.

ORIGINAL:

The universe is vast and unpredictable. Our Commons is taking the bold first steps into a new world brimming with opportunity, but also riddled with risk.

Luckily, we have been given a powerful compass to guide us through uncertainty.

Good and bad. Ying and yang. Luck and misfortune. The wisdom encoded within the numbers 7 and 13 captures the duality of destiny in a way the puny 8 never could. We have followed their lead while designing our commons, and they have made us witness to the pinnacle of paramater design.

FORK THIS PROPOSAL (link)

Summary

Module 1: Token Freeze & Token Thaw

| Parameter | Value |

|---|---|

| Token Freeze | 26 Weeks |

| Token Thaw | 77 Weeks |

| Opening Price | 0.7 wxDAI |

Module 2: Augmented Bonding Curve

| Parameter | Value |

|---|---|

| Commons Tribute | 84.00% |

| Entry Tribute | 3.50% |

| Exit Tribute | 3.50% |

| *Reserve Ratio | 14.74% |

*This is an output. Learn more about the Reserve Ratio here.

Module 3: Tao Voting

| Parameter | Value |

|---|---|

| Support Required | 91% |

| Minimum Quorum | 7% |

| Vote Duration | 7 day(s) |

| Delegated Voting Period | 4 day(s) |

| Quiet Ending Period | 3 day(s) |

| Quiet Ending Extension | 3 day(s) |

| Execution Delay | 1 day(s) |

Module 4: Conviction Voting

| Parameter | Value |

|---|---|

| Conviction Growth | 7 day(s) |

| Minimum Conviction | 6.0% |

| Spending Limit | 20.0% |

Module 1: Token Freeze and Token Thaw

Strategy:

This carefully chosen parameters set the best possible stage for the first steps of our DAO:

213 weeks where tokens are frozen to protect against bad luck, then 117 weeks thaw to guarantee smooth sailing. Also, since 2+11 is 13 cosmic balance is preserved throughout.

(For the non-believers, this would “just” amount to a 6 month freeze and a 1.5 year thaw)

| Parameter | Value |

|---|---|

| Token Freeze | 26 Weeks |

| Token Thaw | 77 Weeks |

| Opening Price | 0.7 wxDAI |

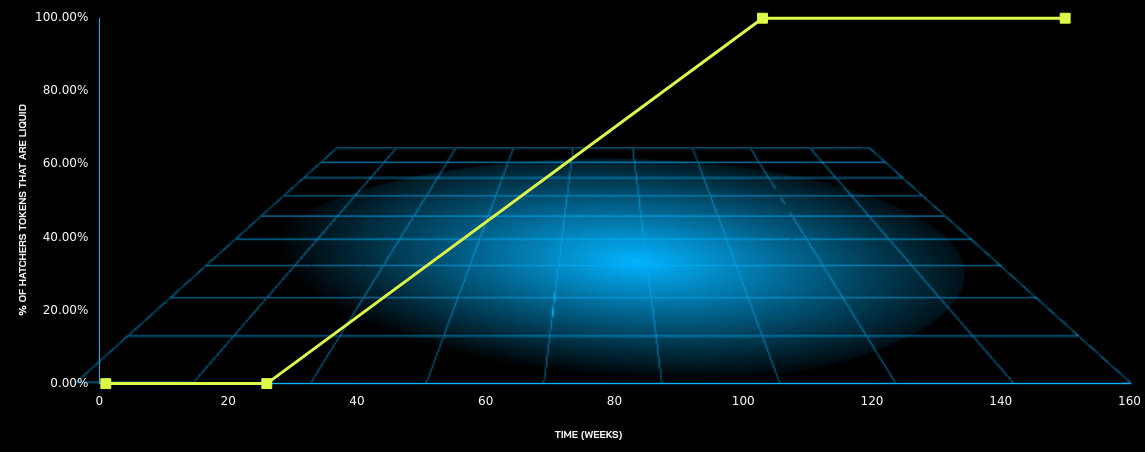

Hatcher’s TEC Release Schedule

This is the release schedule for TEC that was given to Hatchers. Their TEC will start out frozen and then slowly become liquid according to the graph above.

Token Release Timeline

| Duration | % of Tokens Released | Price Floor of Token |

|---|---|---|

| 3 months | 0.00% | 0.70 wxDAI |

| 6 months | 0.00% | 0.70 wxDAI |

| 9 months | 16.88% | 0.58 wxDAI |

| 1 year | 33.77% | 0.46 wxDAI |

| 1.5 years | 67.53% | 0.23 wxDAI |

| 2 years | 100.00% | 0.00 wxDAI |

| 3 years | 100.00% | 0.00 wxDAI |

| 4 years | 100.00% | 0.00 wxDAI |

| 5 years | 100.00% | 0.00 wxDAI |

Module 2: Augmented Bonding Curve (ABC)

Strategy:

Anything involving smart contracts should only ever be exposed to good fortune, so here we bet on 7 :

Opening price of .70$, (1.37 after the initial buy), 7* 12 for commons tribute, and the last 7 as the total tribute paid by somebody who completes the cycle of entering and exiting the TEC.

| Parameter | Value |

|---|---|

| Commons Tribute | 84.00% |

| Entry Tribute | 3.50% |

| Exit Tribute | 3.50% |

| *Reserve Ratio | 14.74% |

*This is an output. Learn more about the Reserve Ratio here.

| Allocation of Funds | wxDAI |

|---|---|

| Common Pool (Before Initial Buy) | 1059427.80 |

| Reserve (Before Initial Buy) | 201795.77 |

| Common Pool (After Initial Buy) | 1068177.80 |

| Reserve (After Initial Buy) | 443045.77 |

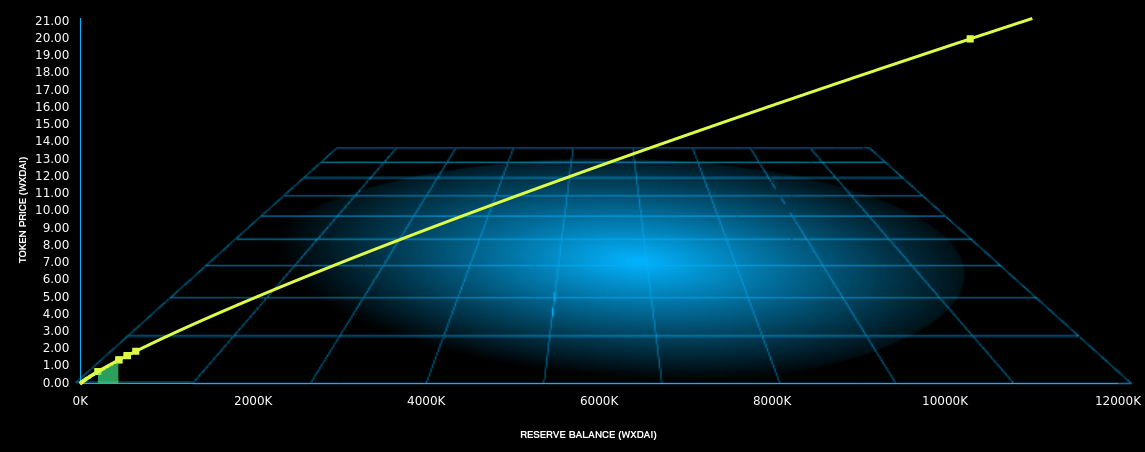

TEC Price vs ABC Reserve Holdings

The ABC mints and burns TEC tokens, the price of the TEC token is dependent on the funds that is held in the Reserve. This graph shows how the ABC’s Price for TEC tokens changes with the ABC’s Reserve Balance. The Initial Buy that will happen at launch is highlighted.

Example Transaction Data

| Tx | Reserve | Total Supply | Price | Amount In | Tribute | Amount Out | New Price | Slippage |

|---|---|---|---|---|---|---|---|---|

| 0 | 201795.77 | 1956421.69 | 0.7 | 250000.00 wxDAI | 8750.0 | 240365.77 TEC | 1.37 | 30.26% |

| 1 | 443045.77 | 2196787.46 | 1.37 | 5000.00 wxDAI | 175.0 | 3508.98 TEC | 1.38 | 0.46% |

| 2 | 447870.77 | 2200296.44 | 1.38 | 100000.00 wxDAI | 3500.0 | 64180.91 TEC | 1.63 | 8.12% |

| 3 | 544370.77 | 2264477.35 | 1.63 | 3000.00 TEC | 170.65 | 4705.00 wxDAI | 1.62 | 0.38% |

| 4 | 539495.12 | 2261477.35 | 1.62 | 5000.00 wxDAI | 175.0 | 2968.96 TEC | 1.63 | 0.38% |

| 5 | 544320.12 | 2264446.3 | 1.63 | 100000.00 wxDAI | 3500.0 | 55118.37 TEC | 1.87 | 6.82% |

| 6 | 640820.12 | 2319564.68 | 1.87 | 10000000.00 wxDAI | 350000.0 | 1172393.23 TEC | 20.0 | 77.22% |

ABC Overview

| Reserve (wxDai) | Supply (TEC) | Price (wxDai/TEC) | Market cap |

|---|---|---|---|

| 10,000 | 1,256,613 | 0.05 | 67,884.97 |

| 50,000 | 1,592,869 | 0.21 | 339,345.91 |

| 100,000 | 1,764,149 | 0.38 | 678,673.37 |

| 200,000 | 1,953,850 | 0.69 | 1,357,325.38 |

| 300,000 | 2,074,140 | 0.98 | 2,035,981.06 |

| 400,000 | 2,163,952 | 1.25 | 2,714,630.96 |

| 500,000 | 2,236,287 | 1.52 | 3,393,289.90 |

| 600,000 | 2,297,178 | 1.77 | 4,071,940.15 |

| 700,000 | 2,349,954 | 2.02 | 4,750,591.49 |

| 800,000 | 2,396,649 | 2.27 | 5,429,247.43 |

| 900,000 | 2,438,607 | 2.50 | 6,107,902.97 |

| 1,000,000 | 2,476,761 | 2.74 | 6,786,553.53 |

| 1,250,000 | 2,559,551 | 3.31 | 8,483,189.93 |

| 1,500,000 | 2,629,246 | 3.87 | 10,179,828.23 |

| 1,750,000 | 2,689,651 | 4.42 | 11,876,463.31 |

| 2,000,000 | 2,743,096 | 4.95 | 13,573,085.06 |

| 2,500,000 | 2,834,789 | 5.99 | 16,966,353.12 |

| 3,000,000 | 2,911,978 | 6.99 | 20,359,631.45 |

| 3,500,000 | 2,978,878 | 7.97 | 23,752,884.95 |

| 4,000,000 | 3,038,070 | 8.94 | 27,146,147.03 |

| 5,000,000 | 3,139,623 | 10.81 | 33,932,679.80 |

| 7,500,000 | 3,332,919 | 15.27 | 50,899,066.17 |

| 10,000,000 | 3,477,238 | 19.52 | 67,865,350.59 |

| 15,000,000 | 3,691,319 | 27.58 | 101,798,087.48 |

| 20,000,000 | 3,851,158 | 35.24 | 135,730,703.57 |

| 50,000,000 | 4,407,862 | 76.98 | 339,326,945.78 |

| 100,000,000 | 4,881,856 | 139.02 | 678,653,849.71 |

Module 3: Tao Voting

Strategy:

Without a doubt, a 7*13 % required support is the perfect metaphor to capture the viscitudes of on-chain governance.

The voting process shall involve 7 days, to adequately ponder weighty decisions.

| Parameter | Value |

|---|---|

| Support Required | 91% |

| Minimum Quorum | 7% |

| Vote Duration | 7 day(s) |

| Delegated Voting Period | 4 day(s) |

| Quiet Ending Period | 3 day(s) |

| Quiet Ending Extension | 3 day(s) |

| Execution Delay | 1 day(s) |

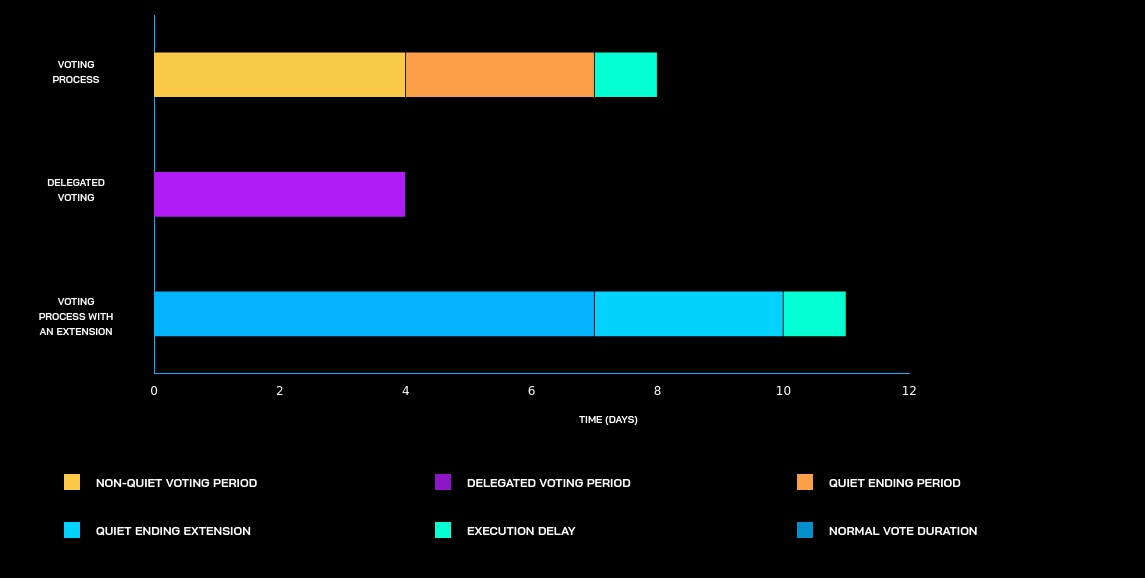

Tao Voting Timeline From Proposal To Execution

This shows how the timeline stacks up for yes/no time based votes that can change the configuration after launch.

Timeline Data

| # of Quiet Ending Extensions | No Extensions | With 1 Extension | With 2 Extensions |

|---|---|---|---|

| Time to Vote on Proposals | 7 days | 10 days | 13 days |

| Time to Review a Delegates Vote | 3 days | 6 days | 9 days |

| Time to Execute a Passing Proposal | 8 days | 11 days | 14 days |

Module 4: Conviction Voting

Strategy:

Fair division: 13% as spending limit and 4+3 for conviction parameters.

| Parameter | Value |

|---|---|

| Conviction Growth | 7 day(s) |

| Minimum Conviction | 6.0% |

| Spending Limit | 20.0% |

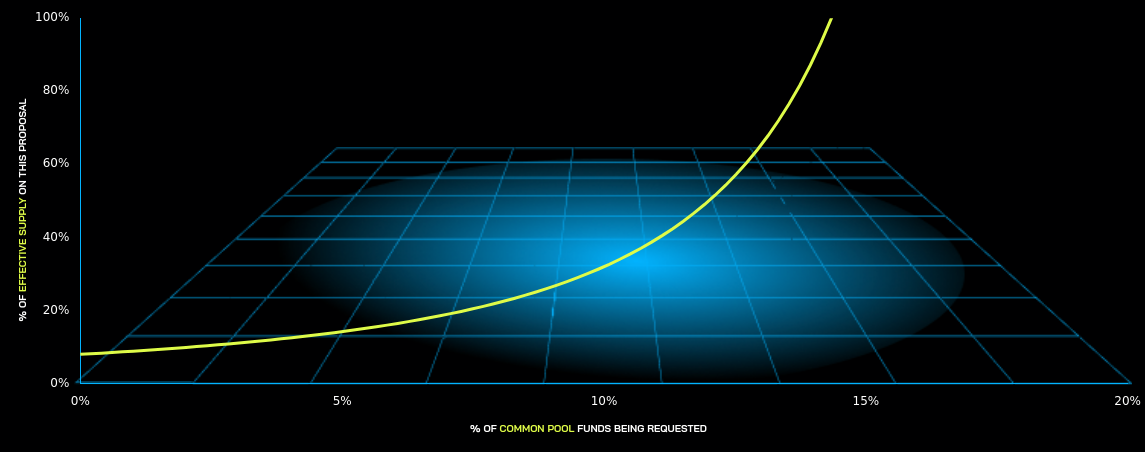

Minimum Percent of Voting Tokens Needed to Pass Funding Requests

This shows how the minimum percent of tokens needed to pass proposals after 2 weeks varies with the percent of the Common Pool funds being requested.

Example Funding Request Data

| Proposal | Requested Amount (wxDAI) | Common Pool (wxDAI) | Effective supply (TEC) | Tokens Needed To Pass (TEC) |

|---|---|---|---|---|

| 1 | 1,000 | 100,000 | 1,500,000 | 99722 |

| 2 | 5,000 | 100,000 | 1,500,000 | 159999 |

| 3 | 25,000 | 100,000 | 1,500,000 | Not possible |

| 4 | 1,000 | 750,000 | 1,500,000 | 91212 |

| 5 | 5,000 | 750,000 | 1,500,000 | 96313 |

| 6 | 25,000 | 750,000 | 1,500,000 | 129599 |

| 7 | 10,000 | 1,000,000 | 2,000,000 | 132963 |

FORK THIS PROPOSAL (link)

Parameter Definitions

Token Freeze and Token Thaw

- Token Freeze: 26 weeks, meaning that 100% of TEC tokens minted for Hatchers will remain locked from being sold or transferred for 26 weeks. They can still be used to vote while frozen.

- Token Thaw: 77 weeks, meaning the Hatchers frozen tokens will start to become transferable at a steady rate starting at the end of Token Freeze and ending 77 weeks later.

- Opening Price: 0.7 wxDAI, meaning for the initial buy, the first TEC minted by the Augmented Bonding Curve will be priced at 0.7 wxDAI making it the price floor during the Token Freeze.

Augmented Bonding Curve (ABC)

- Commons Tribute: 84.00%, which means that 84.00% of the Hatch funds (1059427.80 wxDAI) will go to the Common Pool and 16.00% (201795.77 wxDAI) will go to the ABC’s Reserve.

- Entry Tribute: 3.50% meaning that from every BUY order on the ABC, 3.50% of the order value in wxDAI is subtracted and sent to the Common Pool.

- Exit Tribute: 3.50% meaning that from every SELL order on the ABC, 3.50% of the order value in wxDAI is subtracted and sent to the Common Pool.

Tao Voting

- Support Required: 91%, which means 91% of all votes must be in favor of a proposal for it to pass.

- Minimum Quorum: 7%, meaning that 7% of all tokens need to have voted on a proposal in order for it to become valid.

- Vote Duration: 7 day(s), meaning that eligible voters will have 7 day(s) to vote on a proposal.

- Delegated Voting Period is set for 4 day(s), meaning that Delegates will have 4 day(s) to use their delegated voting power to vote on a proposal.

- Quiet Ending Period: 3 day(s), this means that 3 day(s) before the end of the Vote Duration, if the vote outcome changes, the Quiet Ending Extension will be triggered.

- Quiet Ending Extension: 3 day(s), meaning that if the vote outcome changes during the Quiet Ending Period, an additional 3 day(s) will be added for voting.

- Execution Delay: 1 day(s), meaning that there is an 1 day delay after the vote is passed before the proposed action is executed.

Conviction Voting

- Conviction Growth: 7 day(s), meaning that voting power will increase by 50% every 7 days that they are staked behind a proposal, so after 14 days, a voters voting power will have reached 75% of it’s maximum capacity.

- Minimum Conviction: 6.0%, this means that to pass any funding request it will take at least 6.0% of the actively voting TEC tokens.

- The Spending Limit: 20.0%, which means that no more than 20.0% of the total funds in the Common Pool can be funded by a single proposal.

Advanced Settings*

| Parameter | Value |

|---|---|

| HNY Liquidity | 100 wxDAI |

| Garden Liquidity | 1 TEC |

| Virtual Supply | 1 TEC |

| Virtual Balance | 1 wxDAI |

| Transferable | True |

| Token Name | Token Engineering Commons |

| Token Symbol | TEC |

| Proposal Deposit | 200 wxDAI |

| Challenge Deposit | 400 wxDAI |

| Settlement Period | 5 days |

| Minimum Effective Supply | 1.0% |

| Hatchers Rage Quit | 60000 wxDAI |

| Initial Buy | 250000 wxDAI |