Proposal Title

The Initial Buy-in

Proposal Information

Signal your favour for this proposal on Snapshot

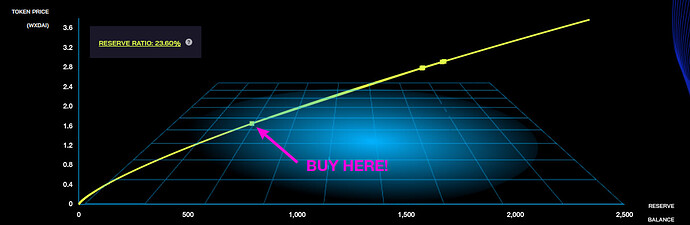

We want to be the first buyers on our Augmented Bonding Curve (ABC)!

This proposal aims to acquire TEC tokens at the moment of initialization of the ABC in order to allow the TEC to acquire tokens at the lowest possible price for key allocations. We will outline what these tokens may be used for, how the tokens will be custodied, governance over the allocation of the tokens and the rationale behind the amount of tokens sought for purchase.

These funds will be taken out of the Hatch funds raised (1.57 million wxDAI) and set aside to purchase TEC tokens at the exact moment the ABC launches.

Experience the ABC on the Commons Configuration Dashboard

Proposal Details

Allocation Amount

250,000 wxDAI buy-in (~15% of Hatch funds) seems to be the most reasonable amount to allocate. After hours of research using our own ABC tool we arrived at this conclusion. You can see in the table below we tested various Reserve Balances and Opening Prices, simulating realistic high-end and low-end values. These two parameters help us determine the Reserve Ratio which can drastically affect the volatility of our ABC.

The sweet spot for the Reserve Ratio should hover around 20% to keep price movement reasonable when transactions are made on the ABC.

If we take the default values on the CCD there would be around 780k in the Reserve Balance and about 480k in the Common Pool. Roughly a Commons Tribute of 38% and an Opening Price of 1.65 with a Reserve Ratio of ~23%. We imagine the amount lost from Hatchers rage quitting is 60k wxDAI (currently it is 35k). In this scenario we receive ~135k TEC tokens. This seems to be a fairly balanced outcome however this will change depending on the final Commons Upgrade parameters chosen.

It’s important to consider that we increase the price of the TEC token by making a buy-in and we can effectively maintain this augmentation by allocating the minted TEC into situations where the tokens are very unlikely or impossible to be sold. We will outline some of these situations further in this proposal.

| 3% | Entry Tribute | 250k Iinitial buy | 250k Iinitial buy | 250,000.00 | 250,000.00 | 250k Iinitial buy | |

| ABC Reserve | Opening Price | Reserve Ratio | Price After Buy-in |

Price Increase

(Slippage) |

Amount in Common Pool | Commons Tribute | APPROX TEC |

| 1,000,083.80 | 1.00 | 49.12% | 1.12 | 12.00% | 259,916 | 20.63% | 235,849 |

| 1,000,083.80 | 2.00 | 24.56% | 2.36 | 18.00% | 259,916 | 20.63% | 114,679 |

| 1,000,083.80 | 5.00 | 9.82% | 6.06 | 21.20% | 259,916 | 20.63% | 45,208 |

| 785,611.79 | 1.65 | 23.39% | 2.04 | 23.64% | 474,388 | 37.65% | 135,501 |

| 600,050.28 | 1.00 | 29.47% | 1.28 | 28.00% | 659,950 | 52.38% | 219,298 |

| 600,050.28 | 1.50 | 19.65% | 1.98 | 32.00% | 659,950 | 52.38% | 143,678 |

| 600,050.28 | 2.00 | 14.74% | 2.69 | 34.50% | 659,950 | 52.38% | 106,610 |

| 600,050.28 | 4.00 | 7.37% | 5.47 | 36.75% | 659,950 | 52.38% | 52,798 |

| 400,033.52 | 1.00 | 19.65% | 1.48 | 48.00% | 859,966 | 68.25% | 201,613 |

| 400,033.52 | 2.00 | 9.82% | 3.09 | 54.50% | 859,966 | 68.25% | 98,232 |

| 400,033.52 | 3.00 | 6.55% | 4.68 | 56.00% | 859,966 | 68.25% | 65,104 |

Eligible allocations

There are two allocation pools we can immediately identify as eligible for the acquired TEC from the buy-in. Additional use cases may be identified in the future. Prior to any allocation, a proposal must be submitted, and passed, by Community vote on Snapshot. The first allocation pool is the Reward System and the second will be allocated for Stategic Partnerships and Secondary Market Liquidity.

Reward System

80,000 wxDAI (32%) worth of TEC will go directly to fund the distributions of the reward system and the management of those funds will be set by the Reward Board.

Ideally, we allocate a portion of these purchased TEC tokens to fund the reward system for 6 months until the Reward Board is settled and can begin making their own funding requests. This will fund our contributors at the lowest price possible, since this value will most likely increase as the value of TEC grows.

Strategic Partnerships & Secondary Market Liquity

This pool will hold a combined 170,000 wxDAI (68%) for distribtution between the two use cases:

Strategic Partnerships

We have a universe of options yet to explore with strategic partnerships. Within the ecosystem, there are a number of DAOs and organizations that are strongly aligned with the mission and purpose of the TEC. In some cases, it will strongly behoove the TEC to have alliances with strategic, value aligned partners and this pool of TEC tokens will be eligible for that purpose. There has already been some progress in this avenue, we discussed some possible partnerships with AGAVE back in September. The TEC has some pending opportunities to form a strategic partnership. Concrete examples of strategic partnerships could look like:

- Favourable price inclusion in the TEC for organizations and DAOs that are mission aligned and will increase our strength in Token Engineering as a field and discipline.

- Swapping governance tokens (and using them to govern)

- Creating token bridges via joint liquidity pools (eg. a TEC/AGAVE LP)

Secondary Market Liquidity

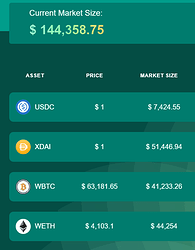

Some of the TEC in this pool will be used to create liquidity pools (LPs) on secondary markets. This will most likely take the form of LP tokens using DEXs on xDai network (eg. Honeyswap, Sushiswap). The secondary market will be inevitable (assuming the TEC token is transferable) and owning a chunk of it will bring it notable revenues from swap fees as interest in the TEC accelerates. Some examples of interesting LP pairs on xDai would be:

- TEC/WETH

- TEC/WBTC

- TEC/HNY

- TEC/xDAI (To benefit from arbitrageurs)

A good secondary market allows for a flourishing economy. Strong liquidity makes it possible for traders to swap tokens at a fair price, and stabilizes the market. With high liquidity comes faster transactions and increases the accuracy for technical analysis.

Custody

Allocations destined for the Reward System will be custodied by the Reward Board. This Reward System Forum post details the choosing and powers of the Reward Board. Further description of the Reward System and Reward Board is outside the scope of this proposal.

Allocations for both the strategic partnerships and secondary market liquidity use cases will be custodied together by an entity known as the Liquidity And Strategic Employment Requests Token Allocation Group (LASERTAG). LASERTAG will comprise 7 members under a 4 of 7 Gnosis safe multisig required to authorize the disbursement of tokens. (This means 4 out of the 7 members must authorize any transaction for it to be executed.)

Members will be nominated and discharged from LASERTAG by a community vote on Snapshot. The only requirement to be nominated is that you must hold TECH tokens, and that you can respond to signature requests on the multi-sig within 24 hours.

Governance

The purpose of the LASERTAG is to execute the terms of the proposals approved by the Community.

This group is tasked with ensuring that the proposals pertaining to these holdings are executed as soon as possible, following a successfully passing vote by the community via Snapshot. For any proposal passed by the Community, LASERTAG is responsible for executing the terms of that proposal.

In the event the terms are not executable, the group will share a transparency post on the forum detailing the specifics and justifications.

Every TEC token holder can submit a proposal and, when passed by Community vote on Snapshot, LASERTAG will execute the terms of that proposal.

In the event a proposal would clearly cause serious material loss to the holdings, this group will raise the flag to the community in order to, potentially, vote to abort the proposal. There are some examples which come to mind here. For example, a case where a late discovery might invalidate assumptions made in the proposals.

Team Information (For Funding Proposals)

This proposal was drafted and will be championed by @Tamara , @ZeptimusQ and @divine_comedian

MAJOR props to @Griff and @laurenluz for running the numbers on the buy-in amount

and thanks to @Juankbell for the graph image.

Funding Information (For Funding Proposals)

Amount of tokens requested:

250,000 wxDAI

Ethereum address where funds shall be transferred:

TBD (Reward Board and LASERTAG will both be Gnosis multisigs)

EDIT 02/11/2021

After some healthy debate between the stewards we have modified this proposal. Notable changes are:

- Anyone who has TECH tokens can be nominated for LASERTAG

- The research component has been removed from the scope of the group, allowing for more inclusive participation.

Also from the feedback received in the comments I have made the following changes to the allocation:

- Combined strategic partnerships and secondary market liquidity into one allocation pool. This allows the community greater flexibility for choosing how much TEC to use for each use-case. (and for new use-cases to be defined)

We will unveil the nomination process in the coming days… stay tuned on the forum for more information.

IN THE MEANTIME - If you have TECH tokens vote on this proposal so we can decide how to decide!

https://snapshot.org/#/tecommons.eth/proposal/0xc26d2b18ff67f6de730a7a6e591885b8c8812f299ec0d3e536db4b5b1ac9000d

EDIT 03/11/2021

Following discussion in the Stewards call today we have nailed down the nomination process for selecting who will be a part of the LASERTAG multisig. The main points are as follows:

- Anyone can nominate a set of 7 TECH holders to become the LASERTAG multisig signers

- The nominator is tasked with ensuring all 7 of their nominees accept the nomination

- Nomination will be done in this thread via comments and will remain open until 11:59pm, Monday Nov. 8 (GMT -6).

- We will take all nominations submissions sent in time and create a Snapshot vote using Ranked Choice Voting to choose the preferred nomination set.

Let the games begin…

).

).