Context

The Tam-Zepti proposal for making an initial buy into our own bonding curve ignited further explorations into possible economic and inter-DAO opportunities for the TEC. Coincidentally, after much anticipation, the AGAVE platform launched shortly thereafter. AGAVE, an offshoot from 1hive, is a protocol built on xDAI for Borrowing and Lending various types of token assets. I saw this as a perfect opportunity to seize the momentum and build on the soft-conensus we found around exploring all the possibilities laid out before us, given the success of the Hatch.

We arranged a meeting on September 6, 2021 with representatives of the TEC and AGAVE and after fruitful discussion I can come forward with three opportunities for us to collaborate with AGAVE and provide economic benefit for the TEC. I will draft three different posts to allow us to accurately discuss and iterate on each proposal.

Proposal #1 - Deposit a portion of Hatch funds in wxDAI into AGAVE

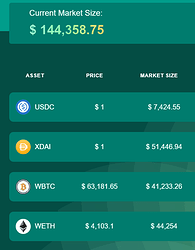

This was a great idea brought forth by @sem where we could take a portion of funds from either the Common Pool (TEC initiative funding), the Reserve Balance (the underlying collateral backing the ABC) or both and deposit it into AGAVE, earning passive, low-risk yield.

Similar to other lending platforms when depositing collateral you receive a token that represents your deposit (with interest added) that you use to redeem the original asset whenever you choose to withdraw (and collect said interest). If we deposit xDAI into AGAVE we receive agxDAI which would be held in our Common Pool or be used as all or part of the base currency for the ABC.

I’ll address using the Common Pool and the Reserve Balance separately since each carries unique risks and benefits.

Common Pool

The most straightforward way to execute this proposal would be to use a portion of our Common Pool funds (based on the Commons Tribute) to earn some passive income. Our Commons Tribute probably will lie anywhere between 20-50% of Hatch funds and it is not likely (hopefully) that we will spend all of that in the near future and we will constantly be collecting more as our Augmented Bonding Curve provides us with a constant stream of additonal funding. Putting in a sizeable chunk of wxDAI from this pool will allow us to get around 3-5% APY back that can be channeled back into our Common Pool and provide more funding for Token Engineering.

The benefit for AGAVE is the TVL and liquidity on their platform allowing them to offer competitive borrowing rates. There was some initial discussion on AGAVE providing us with preferred interest rates for providing collateral, however they have a DAO and a governance process so that needs to be investigated further on their side.

Some questions to consider are:

- How much of the Common Pool funds should be deposited?

- How much should we be able to withdraw at a time?

- Can we trust the AGAVE contracts(which hold our wxDAI)?

- ???

Reserve Balance

This is where it gets a bit spicy, but basically the point is that there will be a huge amount of xDAI held in the Augmented Bonding Curve which will never see the light of day, very likely. We can deposit this xDAI into AGAVE and earn passive yield, thus increasing slowly the value of the TEC token as interest accumulates. This could be implemented in three ways (please correct me if I’m wrong @sem):

- Changing the base currency of the ABC into agwxDAI (buying and selling TEC for agwxDAI).

- Having two ABC’s (one for wxDAI, one for agwxDAI) .

- A hybrid ABC that has two base tokens that accepts or returns a bit of both when transactions are made.

This, while technically can be done, I feel there are significant cultural hurdles that would be needed to make this solution feasible. My personal opinion is we should focus on educating our community and launching our ABC as is without doing any spooky changes that could have technical bugs or unforeseen economic consequences, however I leave it here so we can open up the discussion.

Opening the Discussion

This is a great opportunity for us to explore new platforms and support the protocols being built on xDAI. I think the best way to collaborate with other projects and protocols is to actually use the tools they are building. I’d like to open up the discussion here and I would love to hear from a token engineering perspective any further ideas or perspectives around this proposal!