Provide as much information as possible about your idea.

This post grew from the Sampo working group’s high-level strategy document, which you can find below.

The plan has gotten initial advice from the working group and was presented at last week’s Steward Council. To broaden feedback from the community, I’m posting it here and including a link at the bottom to a quick, easy survey tool. This tool provides some powerful analysis capabilities that will help us easily find where we do and do not have consensus around the ideas in this plan.

How is it relevant to the TEC mission, vision and values?

This plan tests some core assumptions about how we go about developing the TEC micro-economy over the next few years in order to serve our mission, vision, and values.

Who is going to be affected by what you’re proposing?

Most obviously, anyone who is participating in the economic layer of the TEC. But more generally, everyone who cares about this community’s long-term ability to fulfill its mission, vision, and values.

Who has expertise in this topic and could advise your process?

Discourse limits “@mentions” to 10 people, so I will ping people via Discord.

What type of proposal is this?

This is an idea or something I just need advice to proceed with.

Sampo Strategy

Sampo Strategy

Purpose of this Document

Note that this document is not a work plan. We are kicking of much more specific projects and are putting plans and work teams in place to tackle these one by one in short order. There are two goals for writing and getting feedback on this document:

- Getting high-level agreement and conviction for the TEC’s strategies for securing, managing, and investing our financial capital.

- Describe the TEC’s plans for new inflows of capital, to be used in grant applications, individual donor pitches

TLDR:

The TEC is a micro-economy in a process of economic development that will happen over many years. Phase I of this development is about using our limited financial capital to fundraise and build services that grow our social capital, cultural capital, and expertise capital. These services will be the Schelling Point Services for attracting a powerful network of token engineering professionals that will build economic momentum (phase II) and lead us ultimately to economic abundance (phase III).

The Economic Development Lens

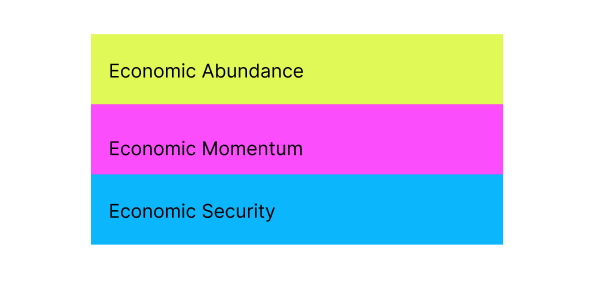

Economies develop over time, and so will the TEC micro-economy. Imagine three stages of development, each with its own implications for the TEC mission:

1. Economic Security:

At the base is the work to ensure the sustainability of the organization and its mission. This stage of the work focuses on reducing risk and being discerning about how we invest in “capacity building” that uses our precious financial capital to build economic momentum.

2. Economic Momentum:

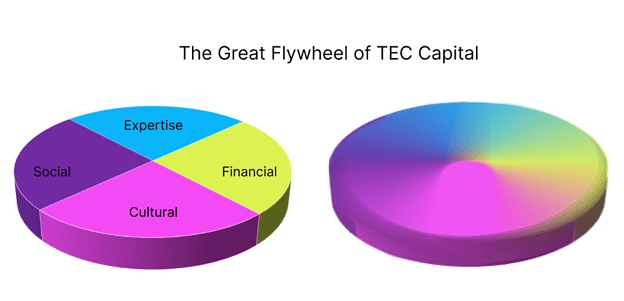

This is where our capacity building investments begin to pay off. The flywheel starts moving with economic momentum that gradually begins to sustain itself. Synergies and network effects start to kick in. Services (like our first one, the TEC’s Augmented Bonding Curve) are generating real value for the users of the TEC as a commons. As more people use these services, income grows as does demand for $TEC. This creates powerful— and extremely valuable— feedback loops.

3. Economic Abundance:

Economic momentum builds, and the network effects and synergy from our unique mix of different types of capital (see below) begin to generate surplus value. As this value accumulates, the TEC begins to build lasting community wealth—the inexhaustible treasury of the Sampo legend. At this stage, more of the work shifts to using community wealth as a tool for spreading our mission far and wide; well beyond the TEC itself.

Economic Development Lens Implications:

Our mission specifically notes that, “our economic layer will fund projects that discover, develop and proliferate the best practices for engineering safe tokenized economies, while aligning our collective success with the individual benefit of token holders.” The economic development lens suggests the following about the TEC economic layer:

- At the economic security stage, we reduce risk and target our investments to maximize capacity building that gets us to stage two

- At the economic momentum stage, we monetize and tokenize the capacities built in stage one, largely by growing usage of our services

- At the economic abundance stage, we greatly expand funding to external work that supports the TEC mission

Think of it like flying a kite. At first, it’s all about keeping it from crashing into the ground. Then, it’s about getting some elevation. And finally, you soar in the open skies with the freedom to make huge, sweeping moves without fear of crashing.

The Capital Formation Lens

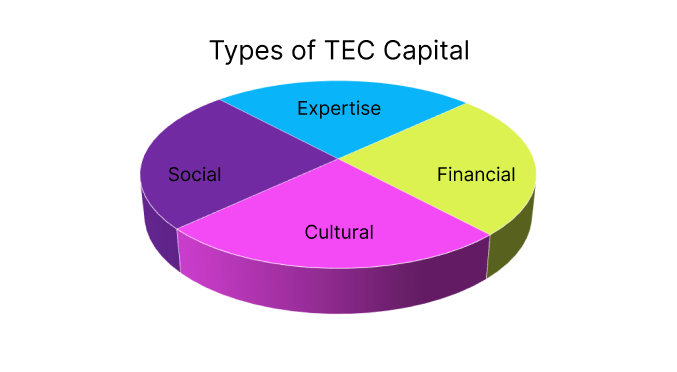

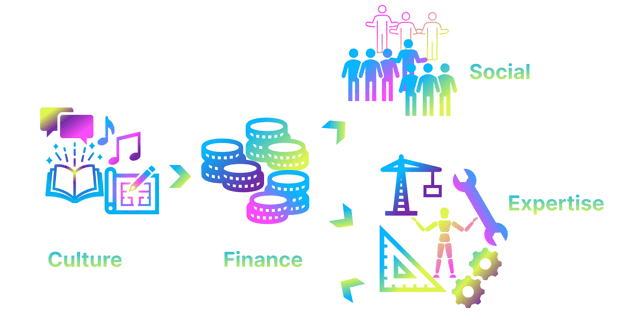

The TEC has four main types of capital (cultural, financial, social, and expertise). We start by leveraging our strong cultural capital to attract new financial capital, which we use to fund capacity building that grows social and expertise capital.

What is the Capital within Our Commons?

David Bollier describes a commons as a “distinct community with a set of social practices, values and norms that are used to manage a resource.” Our resource is the field of token engineering itself. But what does this resource actually look like?

The TEC’s 4 Types of Capital

Capital is a useful lens for answering this question about what we hold in our commons. Capital is not just money. Our friend (and TEC Hatcher), Gregory Landua has written about different types of capital and though the TEC has many types, for our current purposes, it’s worth focusing on four:

The angle in the above graphic is deliberate (even if the size of each slice of the pie is anyone’s guess) and suggests a few things about building TEC capital over time. In the foreground is cultural capital, which is our distinctive advantage right now, and in the background is expertise capital, which is our long-term goal.

Cultural Capital: the TEC’s Initial Lever

Without understanding the TEC, one might believe this community had over-invested in its cultural build. It is true that we have invested significantly here—far, far more than most any other DAO. But there is tremendous power in culture. Culture is magnetic. It captures people’s imagination and stirs their hearts. The TEC’s cultural build brings resilience to the TEC, which in itself is an important contribution to economic stability. Culture is an immeasurable source of value, and the perfect form of capital with which to begin our journey of economic development.

Financial Capital: the Medium for Capacity Building

In Web3, we’re used to thinking more about non-fungibility thanks to Non-Fungible Tokens (NFTs), but fungibility is a really important attribute of financial capital that makes it essential as a medium of exchange. For our purposes, financial capital is a medium for investing in our other forms of capital through the work of capacity building (see below).

The best kind of financial capital comes with no strings attached, and our remarkable community-backed financial capital has kept us independent from venture capital and other potentially extractive external investors. This independence frees us to design the next steps of our capital formation.

That freedom is not absolute, however, because the financial capital we raised was finite, is being spent rather rapidly, and is not currently being replenished. This gives us a shrinking window within which to invest what remains in distinctive other forms of capital that build stakeholder value and an ongoing stream of new financial capital for the TEC.

Social Capital with Builders, Governors, and Users

Social capital emerges through relationships—in our case, relationships with TEC stakeholders. It’s useful to break these relationships into three groups: builders, governors, and users. And, yes, there is significant overlap among these three.

Our strong culture runs deep among the TEC’s builders and governors. It’s the resulting “strong ties” that make this community so attractive. Our work now is marrying these strong ties with great work processes for building mission-aligned value: a balance of tasks and relationships that we’ve already shown we can achieve.

Network theory teaches us that weak ties will also prove essential to our success. This is particularly true for the third category of stakeholders: end users. These people have yet to show up because we have not yet built the services needed to attract and serve them. As we do, we will need systems for holding weak ties on a scale that generates the kinds of network effects that create so much value for permissionless “automated self-services platforms” like Amazon, Google, and Facebook.

Building social capital with a large network of TEC users will require its own special brand of capacity building. One of the first steps will be clearly defining exactly who these users are. Our mission of being the Schelling point for the token engineering community points the way. In Communitas, we are investing in the processes for onboarding and engaging builders and governors right now and eventually this will need to expand to include users.

Expertise Capital: TEC’s Ultimate Lever

Expertise in token engineering will ultimately prove to be the primary form of capital that the TEC will inevitably need to serve our mission. Token engineering expertise will be the lifeblood of our mission; the primary resource held in our commons.

TEC’s contributors are now building the DAO with all its constituent systems and services to house that expertise. Our governors will play a critical role in guiding the future direction of this expertise, and (hopefully) applying it for regenerative rather than degenerative purposes. The most interesting question for our current purposes of setting a vision for Sampo, however, is how TEC’s users will engage with this token engineering expertise.

At a basic level, there are two ways we will serve our users. “Expertise capital” is actually a fusion of what Gregory Landua describes as two types: experiential and intellectual capital. Michael Polanyi calls these types tacit and explicit knowledge. Tacit is the experience-based knowledge embedded in a person. It is learned. Explicit knowledge is codified in speech, writing or code. It is symbolically represented.

Experiential token engineering expertise is an exceedingly rare and precious form of capital in these early days. Cultivating and expanding this capital pool is largely the education work of the Token Engineering Academy.

Embedding token engineering expertise directly into symbolic representations in the form of code and writing is the next phase of our work. It is how the TEC will serve networks of users on a very large scale. It boils down to building automated “Schelling Point Services" for curating and delivering token engineering expertise. We actually have one that has already been launched: our Augmented Bonding Curve, the automated interface through which users buy and sell $TEC to support our mission of growing token engineering expertise.

Capital Formation Strategy

These, then, are the basic elements of the TEC’s capital formation strategy. Our thesis, or “theory of change,” is that there is a particular path to growing these four forms of capital. Think of it as a “capital formation strategy.” In the simplest terms, it looks like this:

- We start with cultural capital because that is the TEC’s greatest source of existing strength. We leverage that cultural capital to tell a compelling story that helps us raise our next round of funding.

- We conserve our existing financial capital since it is the precious resource that enables us to continue to build our cultural, social, and expertise capital even as we raise this next round of funding.

- We use the next rounds of funding to build our first services. The Token Engineering Academy partnership is our primary focus on this front right now. We then define our next wave of Schelling Point Services and then build MVP (Minimum Viable Product) versions as part of our efforts to attract the social capital of an expanding network of relationships with TEC users.

- Once these services are up and running, they begin to generate economic momentum in the form of revenues and demand for the $TEC utility token. This growing common pool of financial capital then funds continued investments in cultural, social, and expertise capital. These forms of capital increasingly blur through growing synergy between them. Our capital starts to spin with greater and greater, like a great flywheel of economic momentum:

The Role of Capacity Building

“Capacity building” is a term from the nonprofit world that is used to describe investments that grow an organization’s ability to financially sustain itself and serve its mission. This is exactly what the TEC needs to do and it is a good frame for helping us to prioritize investments of our precious financial capital, especially in the “economic security” and “economic momentum” phases in the development of our micro-economy.

In the near-term, the capacity building lens should serve as a guide for prioritizing our budgets and the proposals that we fund through conviction voting. For the foreseeable future, we should be asking ourselves hard questions about funding proposals that do not result in clear increases in our ability to build capacity around our cultural, financial, social, and expertise capital. This may seem a controversial statement, but the long-term potential for the TEC to become a truly great force in history utterly depends upon how we manage these investments over the next year. There is no do-over. We need to be very wise about how we invest the precious and limited financial capital that our stakeholders have placed in our care.

Call to Action: A Quick Survey!

The way we think about these issues will have a huge impact on the TEC over the next few years. You can take this quick and very easy assessment of the key ideas in this document and provide valuable feedback on where we’re headed.

Here’s the link:

Just read each statement, like the one below, answer with “agree,” “disagree,” or “pass/unsure” and it will automatically take you to the next statement. We’re testing out this technique as an extension of the TEC advice process. So, please give it a shot.

Team

Team