Hello TEC Community,

Thank you for your support in GG20. I’m really excited to be included in GG21! Here is an update on developments since GG20.

You can support Super DCA in GG21 here: Gitcoin | Explorer

Super DCA App Deployment

- The frontend application that I’m using to test the protocol is now available at:

- Call to Action: I could use the community’s help to get a small amount of volume flowing through the network. So, if you plan to do some DCA from USDC to ETH or OP, please consider trying Super DCA when you do it.

- Important: You need to use Bridged USDC (USDC.e) on Super DCA.

Super DCA Liquidity Network Bootstrapped

- A small network has been established using the Super DCA token on Optimism.

- Contract Address: op:0xb1599cde32181f48f89683d3c5db5c5d2c7c93cc

- This network is small but has concentrated liquidity.

- Despite the small amount of liquidity, the Super DCA Liquidity Network can still achieve very little slippage due to Uniswap V3’s design.

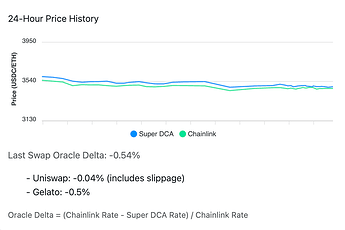

- The image below shows that even with limited liquidity, the all-in price delta (fees + slippage) is 0.54%, which is in line with other protocols’ fees of 0.5% to 0.6%.

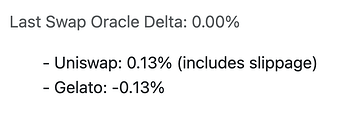

- Under ideal conditions (low gas & volatility), the Super DCA Liquidity Network design achieves a 0% oracle delta, meaning no fees or slippage occurred on the swap.

- Call to Action: Please consider getting some DCA tokens and adding liquidity to the DCA-USDC.e, DCA-ETH, and DCA-OP pools on Optimism. There are DCA token rewards for LPs.

Website

I put together a website for the project, which helps a lot when sharing it. The website has links to the white paper and the app.

Challenges You Could Help With

- First, it helps to have more people doing DCA on Super DCA for it to work optimally. More volume = lower fees for everyone. So give it a try on Optimism today!

- Second, it helps to have more liquidity providers for DCA pairs on Uniswap V3 on Optimism. Please get some DCA tokens and add some liquidity to pairs: DCA-USDC.e, DCA-ETH, and DCA-OP. If you need help getting DCA tokens to LP with, get in touch with me! There are DCA tokens available. LPs for these pairs also receive emissions of DCA tokens, so there is a reward for LPs.

Thank you for your support!

This is a research project that has been very hard to fund. Thanks to TEC, I have been able to get this project on-chain, and it has now been collecting three months of activity data. Heading into GG21, I’ll be working on several improvements to the application and protocol, as well as producing some Dune Analytics Dashboards to track the performance of this system.

Regards,

Mike Ghen (@mikeghen)