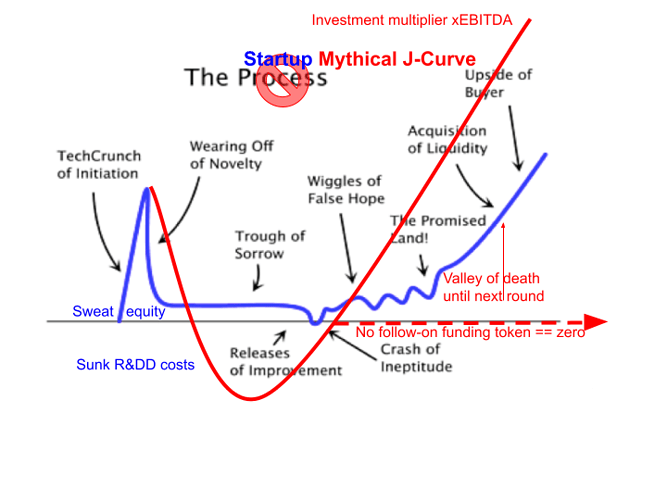

IMO this sudden crash of $TEC and the funds shortage is the best thing that could have happened to the CS/TEC Ecosystem. That its happening when there is a distinct possibility of the global economy sliding into a rcession, macabre as it may sound it only adds to the possibilities. However, since there is a sense of desperate urgency prevailing over this issue, let us focus on the immediate measures and then invite a discussion on the longer term strategy but only after a detailed SWOT analysis.

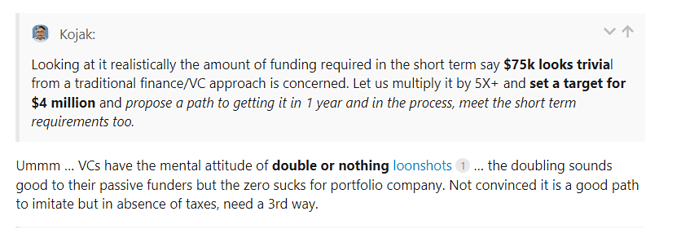

Looking at it realistically the amount of funding required in the short term say $75k looks trivial from a traditional finance/VC approach is concerned. Let us multiply it by 5X+ and set a target for $4 million and propose a path to getting it in 1 year and in the process, meet the short term requirements too.

There has to be an honest and transparent SWOT analysis done to pinpoint what exactly are the Strengths (they are huge), the Weaknesses (the initial design?) what are the Opportunities (they are also huge) to overcome the emerging Threats (the immediate one of a possible funds shortage).

On Strengths, in as much as Web3 is set to transform everything around us,everywhere, CS/TEC Ecosystem is actually leading from the front in as far as the creation of Public Goods. But from a Token Engineering standpoint, the ramifications are far greater and allow me to make a fairly radical case and additionally also draw from the experience of XPrize and Google X on how this can be tackled.

-

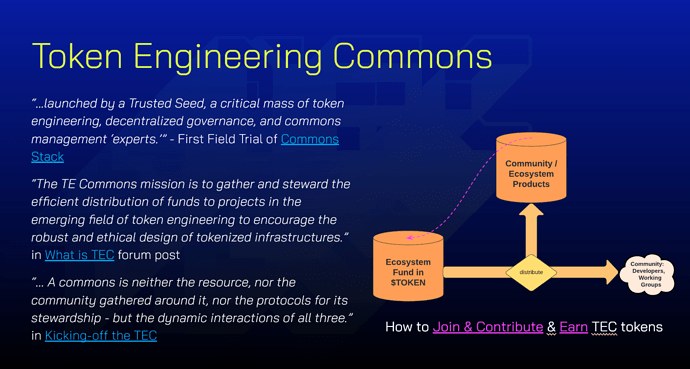

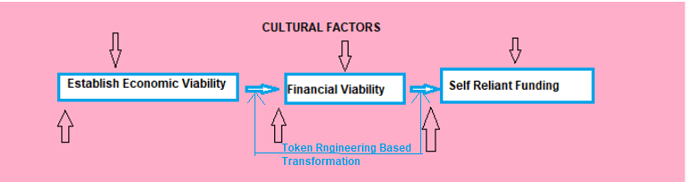

If any flow of value of value can be tokenised then the CS/TEC ecosystem represents a massive flow of value, all of which can be tokenised. From The TE Academy to Gravity to each and every nomination in the CS Prize. Once tokenised these initiatives can attract funding through innovative Token Engineering/Economic Design as explained below.

-

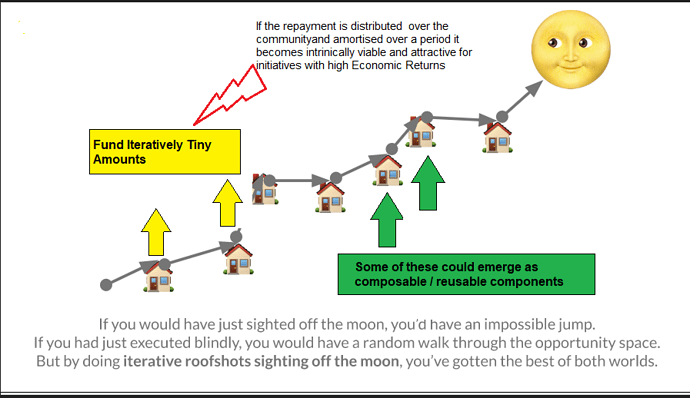

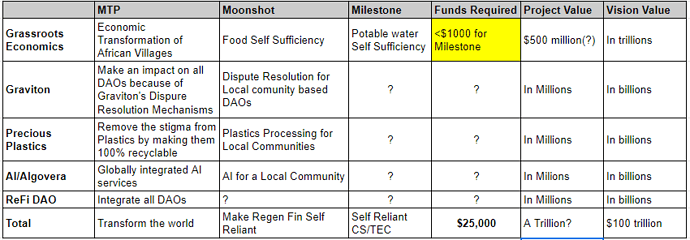

A short list of initiatives should be made, each framed against a much larger MTP ( Massively Transformative Purpose) and each having a Moonshot identified which if achieved releases the “exponentiality” of the initiative. Plus Milestones to the Moonshot. The strategy is to fund the Moonshots or Milestones as Challenges, within the scope of CS/TE. A crude exercise for the short listed nominations looked like this:

The funds being deployed are a miniscule portion of the total projects size. If the short listed projects have high economic returns, then the beneficiary community will be able to pay market interest rates (debt) or bear the risk ( tokens/equity) . (Watch/Read the Villagers Commons presentation/report on how self sufficiency in potable water could be achieved in a Kenyan village by just paying $0.04 cents per month per family for 3 years and in the process build a large corpus too for further deployment.)

- The short listed initiatives should have identifiable beneficiaries who are willing to underwrite the borrowings to implement the milestones. If initiatives with high Economic Returns are identified like GrassEco,Gravity and the rest, with decent Token Engineering/ Economic Design can translate into attractive Financial Returns and then Sustainable Returns via an appropriate token mechanism.

IN EACH SUCCESFUL FUNDING, CS/TEC CAN ALSO BE FUNDED The target is $4 million in 1 year.

What is critical here is good application of Token Engineering.

as

as